AFP/Bangkok

Thailand’s tourism industry may have bounced back after previous bouts of political unrest but a bomb attack in Bangkok targeting foreigners will likely prove a more formidable challenge, analysts say.

Monday night’s blast, which killed 20 people – more than half of them foreigners – was unprecedented for Thailand, despite a history of coups and a decade of instability that has at times turned violent.

The blast hit one of the Thai capital’s most popular commercial hubs, ripping through a crowd of worshippers at a Hindu shrine close to five-star hotels and upscale shopping malls.

The attack “could undermine the recovery in the tourism industry, deepening the country’s economic woes”, said BMI Research, a subsidiary of financial information provider Fitch Group.

The ruling junta that seized power in a coup in May last year was swift to say the perpetrators of the attack were targeting the country’s crucial tourism sector, although who exactly was behind the attack was not yet known.

Tourism was one of the few bright spots in the struggling Thai economy after a difficult year and the government had been hoping to see a surge of tourists in October, particularly among Chinese visitors.

The blasts came just hours after data showed Thailand’s economy had slowed in the second quarter, hit by weak domestic demand and exports.

Tourism, which accounts for 10% of the country’s GDP – or up to 20% by some calculations including its indirect contribution to the economy – was one of the few growth areas.

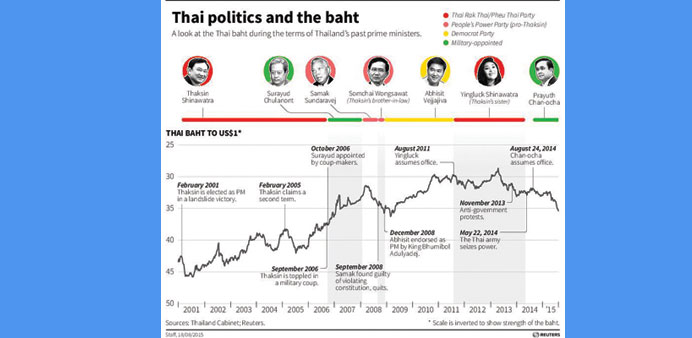

With fears rife over how the bombing will impact the economy, the baht currency slumped to a six-year low and the stock market dived 2.6%, with tourism-related companies suffering the worst of the losses.

“A loss of momentum in the tourism sector – the only firm growth driver in Thailand currently – will present a new downside risk to economic activity,” Australia’s ANZ bank said in a research note.

It warned that the bombing had the potential to damage the tourism sector even more than previous episodes of unrest. Since 2006, Bangkok has witnessed repeated rounds of deadly violence, flanked by two coups that have seen the military claim the streets, and the 2010 occupation of parts of the capital by anti-government Red Shirts that was crushed by soldiers.

“Previous declines in tourist arrivals have been temporary in nature as previous episodes of political unrest in 2006, 2010 and 2014 indicated. The risk is that a bombing could be perceived as a more negative development than political unrest,” ANZ said.

“Tourism – which was a key growth driver in Q2 economic growth – will bear the brunt”.

Earlier this month the Tourism Authority of Thailand said arrivals were at 12.4mn in the first five months of this year, a 25% increase on the same period last year when Bangkok was hit by street protests that eventually led to the military coup.

But until Monday, foreigners had rarely been caught up in the political woes and several countries immediately reacted to news of the blast by advising citizens to be extra vigilant.

Hong Kong even went as far as to advise its residents against non-essential travel to the Thai capital.

The Erawan shrine targeted in Monday’s bombing is an enormously popular site dedicated to the Hindu god Brahma but is visited by thousands of Buddhist devotees every day.

It is particularly popular with Chinese visitors, who travel to Thailand in larger numbers than any other nationality - fourmn arrived in the first six months of this year alone.

Thailand had been expecting a surge in Chinese visitors in October for the annual National Day holiday, but that is now in doubt after the attack claimed the lives of three Chinese and wounded some 28 others. BMI said the blast would add to the country’s economic woes, especially since the economy was still recovering from the political turmoil that ended with last year’s coup.

The “tourism sector as well as the ‘hotel and restaurant’ industry could suffer a setback, undermining government efforts to bolster the ailing economy”, it said.

The sight of extra security forces in the capital would further weigh on wavering investor and tourist confidence, it added.

Meanwhile, Thailand’s currency slumped to a six-year low yesterday and shares fell in Bangkok over concerns an unprecedented attack in the capital could hit the vital tourism sector.

At least 20 people were killed and over 120 wounded when a bomb ripped through a Bangkok religious shrine late Monday, in what authorities said was the worst ever attack on Thai soil and targeted at foreigners.

The baht fell as much as 0.8% to 35.648 against the dollar yesterday, touching its lowest point since April 2009. It closed at 35.556. Bangkok shares slumped as much as 2.8% in opening deals, their steepest decline this year. The market ended down 2.56% or 36.13 points at 1,372.61.

Tourism-linked companies led the sell-off, with Airports of Thailand plunging 6.62% while Central Plaza Hotel tumbled 10.60%.

“Thailand is vulnerable right now as economic growth and corporate earnings are weak, while tourism is not doing great,” Andrew Stotz, CEO of Bangkok-based Stotz Investment Research, told Bloomberg News.

The timing of the blast just as “we’re coming into this high tourism season” means it could be particularly damaging to the sector, which accounts for 8.5% of GDP, he added.

Chinese, Hong Kong, Singaporean, Indonesian and Malaysian citizens were among those killed in the attack on the Erawan shrine in the heart of Bangkok’s tourist and commercial centre.

Morgan Stanley said big-spending Chinese tourists - whose numbers have soared in recent years, bucking a general downtrend - are particularly likely to be put off by the unrest. Last year around 4.6mn Chinese nationals visited the kingdom, with the average tourist spending 5,500 baht ($155) per day, more than the average European visitor.

WWWThe attack comes after Thailand’s economy slowed in the second quarter, hit by weak domestic demand and exports, with growth expected to be hampered this year by China’s devaluation of the yuan.

Gross domestic product grew 2.8% between April and June compared to a year earlier, official data showed on Monday, slowing from three% in the previous quarter.

Hours before the blast, Thailand’s planning board trimmed its 2015 growth forecast to 2.7-3.2%, down from 3-4%. It also warned growth faces “major constraints” after China devalued the yuan last week, sparking fears of a currency war in Asia.

The Thai baht is among several Asia-Pacific currencies that have slumped since the yuan cut, suffering their worst two-day sell-off since the Asian financial crisis last week.