By Arno Maierbrugger

Gulf Times Correspondent

Bangkok

Vietnam has taken the lead in the list of the world’s top Business Process Outsourcing (BPO) locations for the first time in terms of costs, risks and operational conditions. This is shown in a newly published report by US-based global real estate adviser Cushman & Wakefield entitled “Where in the World? Business Process Outsourcing and Shared Service Location Index 2015”.

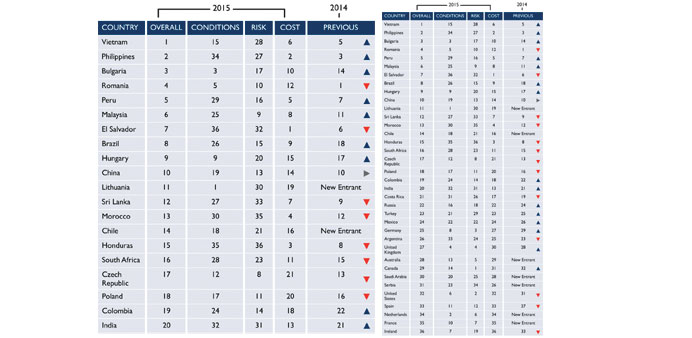

Vietnam jumped from rank 5 in 2014 to pole position in 2015, while the Philippines just improved one notch from rank 3 to 2. Last year’s leader, Romania, fell back to rank 4.

Cushman & Wakefield’s methodology is based on an evaluation of costs, risk factors and operating conditions which are analysed for each country to provide insight into which markets are particularly attractive for BPO in the current global environment. The list is not ranked by overall value or turnover of a particular market, whereby in this case India remains the world’s largest BPO market with 2.8mn people employed and approximately $19bn export value of BPO services in 2014, and the Philippines taking a solid second place with 750.000 people employed and $14.4bn export value. Other top BPO players by export value are China, Brazil, South Africa and Sri Lanka, with the leading Middle Eastern countries offering BPO services being Morocco, Egypt and Turkey.

According to Richard Middleton, Cushman & Wakefield’s Head of Occupier Services for Asia-Pacific and Europe, the Middle East and Africa, Vietnam has benefited from its government’s policies to promote the country as an outsourcing destination, with the services segment expected to expand rapidly given that the average age of the country’s workforce is below 30 and up to 1.5mn people are entering the labour market every year. Government incentives have also led to a fast growing software industry with now more than 1,000 companies employing a workforce of around 80,000 labourers. In recent years, Vietnam has become one of the world’s largest software exporters in the world and has already grown to the second biggest BPO and IT outsourcing destination for Japan behind the Philippines, for example.

“While not the cheapest outsourcing destination, Vietnam is still very competitive when compared to other global locations as wage rises in India and China largely contributed to it surging up the ranking to take first place in 2015,” Middleton said, adding that the Philippine market in the meantime has been “maturing” towards an established BPO destination.

As for the rest of Southeast Asia, the only other country ranking in the top 20 of the list is Malaysia on rank 6, facing increasing challenges from BPO destinations in Eastern Europe such as Romania, Bulgaria, Hungary, Czech Republic, Poland and – as a new entrant – Lithuania, all countries with well-educated staff and still relatively low labour costs that have emerged as European BPO hubs. Another new entrant in the market – from the Middle East – is Saudi Arabia, ranking 30 on the 36-county list. The cheapest BPO destination on the list is El Salvador, but it has the list’s worst operating conditions and one of the worst business risk rankings.

Overall, the global BPO market is expected to reach revenues of $93.4bn in 2015, up at an average annual growth rate of 5.4% from $71.9bn in 2010, according to a forecast by UK-based market researcher Ovum.