Reuters/Paris

Europe’s stock rally lost steam yesterday, with a benchmark index retreating from a seven-year high, after Germany rejected a new proposal from Athens for an extension of its bailout programme.

The German finance ministry described the Greek proposal as “not a substantial solution” because it failed to fulfil the conditions of an EU/IMF bailout programme. Greek Prime Minister Alexis Tsipras had promised to ditch those requirements when he won an election last month.

With the programme due to expire in a little more than a week, Greece urgently needs to secure a financial lifeline to keep the country afloat beyond late March.

European stocks had rallied earlier in the session, with the FTSEurofirst 300 index climbing to as high as 1,522.25 points, a level not seen since late 2007, after Greece made its proposal for a six-month extension of the bailout.

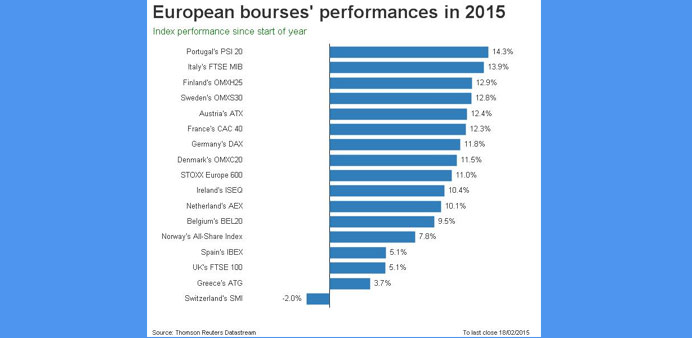

But the benchmark index trimmed gains and ended 0.3% higher at 1,520.22 points. So far this year, the FTSEurofirst 300 has surged 11%, outpacing Wall Street’s S&P 500, up 2% over the same period.

The Athens Stock Exchange FTSE Banks Index closed up 5.4%, after rising by as much as 15% during the session, and extending its recent rebound from a 75% slump since March 2014.

Alpha Bank shares rose 6.4% and Eurobank gained 2.6%.

“At this point, investors think that even if a deal is reached, it won’t mean that the ‘Greek issue’ will be resolved,” Mirabaud Securities senior equity sales trader John Plassard said.

“There will be serious doubts on whether Greece will fully implement the agreement.”

Around Europe, UK’s FTSE 100 index lost 0.1%, Germany’s DAX index added 0.4%, and France’s CAC 40 gained 0.7%.

France’s Capgemini surged 4.9% after the IT services company said it expected sales to accelerate this year with improved profitability, fuelled by strength in the North American market.

Germany’s Rheinmetall gained 7.9%. It reported a 76% jump in fourth-quarter orders at its problem-hit defence division.

Randstad rose 7.3%. The Dutch employment services group posted a 26% rise in fourth-quarter core earnings and said growth had picked up in the first months of 2015.

Shares in Air France-KLM fell 5% after the group warned that overcapacity on some routes and currency swings would offset gains from lower oil prices this year. It will step up cost cuts and ease a key debt reduction goal.

Half-way into the earnings season, European corporate results have been positive, with 56% of companies meeting or beating earnings forecasts, according to Thomson Reuters StarMine data. In absolute terms, quarterly earnings are up 8.6% on average and 23% when excluding results from the energy sector, hard hit by the drop in oil prices.