Reuters

Boston

A massive effective devaluation of Venezuela’s bolivar currency will likely badly dent 2015 earnings at a swath of major US companies.

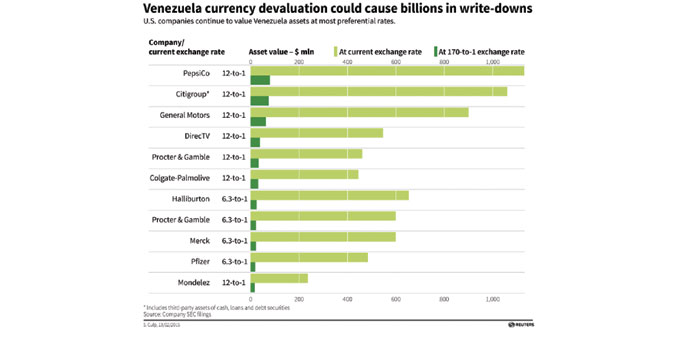

The decision, announced late on Thursday, would almost wipe out the $7.1bn of Venezuelan monetary assets currently held on the books of 10 large American companies. At the new exchange rate of about 170 bolivars to the dollar, the value of those assets would drop by 93% to just $421mn, according to a Reuters analysis of regulatory filings.

Currently those assets are valued based on the main official rate of 6.3 bolivars to the dollar, or a second rate at 12 bolivars. However, the Venezuelan authorities only allow a limited amount of business to be done at those rates as the country suffers from a shortage of available dollars.

Some companies, such as diapers and tissue maker Kimberly-Clark Corp, had recently taken big charges after valuing their assets at a third exchange rate of about 50 bolivars to the dollar, rather than the 6 or 12.

However, that part of the system has now been replaced with the new free-floating rate, which was last quoted on Friday at 174 (even weaker than 170 on Thursday). That puts even the companies who had started to use 50 in a position where they may have to take another hit. The move represents an effective devaluation of more than 70%.

The currency move is part of President Nicolas Maduro’s efforts to shore up the Opec (Organisation of the Petroleum Exporting Countries) member’s coffers amid tumbling crude oil prices, an annual inflation rate of around 64%, and a shortage of many goods in the shops.

Among the companies still using the 6.3 rate still are household products maker Procter & Gamble, oil services group Halliburton Co, and drug companies Pfizer and Merck & Co.

The drug companies may have a better argument for using this rate than most because Venezuela does allow it to be used for the purchases of some critical goods, such as medicines.

Others use the 12 rate. PepsiCo recently started valuing some of its assets in Venezuela at that rate, after being unable to repatriate money at the 6.3 rate for years.

But with this week’s further devaluation of Venezuela’s currency, even the 12 rate seems increasingly imaginary.

“6.3 is ludicrous in my view for most companies,” said Ali Dibadji, an analyst at Sanford C. Bernstein & Co.

The introduction of the new rate may help ease market concerns about a possible debt default and boost supplies of dollars to a currency-starved economy. But some investors see the effective devaluation as cosmetic. There continues to be the reality of runaway inflation and swelling supermarket lines.

“For the most part, the market’s view is that things will be horrendous in Venezuela for quite a while,” said David Whiston, a senior equity analyst at Morningstar.

The new Simadi exchange rate is close to Venezuela’s black market rate of 188 bolivars per dollar, which finance industry leaders described as a sign the government is willing to allow supply and demand to set prices.

PepsiCo has one of the largest stated exposures to Venezuela with assets there valued at $1.13bn using the 12 bolivars exchange rate, company filings show. Those assets would be worth only $79.1mn at the 170 rate.

The company said earlier this week in its annual results filing that re-measuring its Venezuela assets at a 50 bolivars rate would trigger a net charge against earnings of about $400mn. It did not respond to requests for comment on Friday.

The devaluation could encourage more major American companies to follow in the footsteps of Ford Motor Co, which announced in January that it was removing the results of Venezuelan subsidiaries from its core operating results. Others may just pull out altogether, as consumer products company Clorox did last year. Toy maker Mattel Co has said it will consider doing the same if conditions worsen.

Morningstar’s Whiston said he expects other companies to distance themselves from Venezuela’s troubles to avoid frequent currency hits to their earnings.

A rarely used accounting rule allows companies to remove the results of a business if they have effectively lost control of it. They have to mark the assets concerned to “fair value” and take a one-time charge against earnings if necessary.

In Ford’s case, it took a pre-tax charge of $800mn for the fourth quarter of 2014, declaring that foreign exchange and other regulations “have constrained parts availability and are now significantly limiting our Venezuelan operations ability to maintain normal production.”

Ford consulted the US Securities and Exchange Commission before making the accounting change. A spokeswoman for the SEC declined comment.

Another major US company, industrial and consumer products maker 3M, said this week that it may need to remove its Venezuelan operations from its operating results because of bolivar exchange problems “coupled with an acute degradation in the ability to make key operational decisions due to government regulations in Venezuela.”

The benefit of removing bad numbers from operating results at the stroke of a pen is that it means a company avoids the drip-drip of hits to earnings that happens when a currency like the bolivar is slumping over an extended period.

“You anticipate the future losses and take it all in one year because the market will ignore that sort of thing,” said Robert Willens, an independent corporate tax and accounting adviser. “Ongoing losses will not be ignored.”

The exception would be if a company doesn’t take a large enough charge to start with. In that case, there could be further impairment charges as future assessments show that Venezuelan assets are overvalued in accounts.

“You’re taking a large charge anyway so you might as well take the maximum,” Willens said. The company is not hiding losses, but accelerating them, he said.