Almost 85% of the projects in the pipeline are directed towards implementing and delivering on Qatar National Vision 2030 long-term targets rather than simply focusing on FIFA 2022

Project spending trends in Qatar remains strong, says Standard Chartered Bank which estimates another QR40bn ($11bn) worth key infrastructure projects will be awarded in the country before the year-end.

Qatar awarded more than QR47bn ($13bn) of infrastructure projects in the first half of 2013, up 60% increase on the corresponding period in 2012, StanChart said in a country report.

The bank estimates project awards exceeding QR87bn ($24bn) in Qatar for 2013 as a whole.

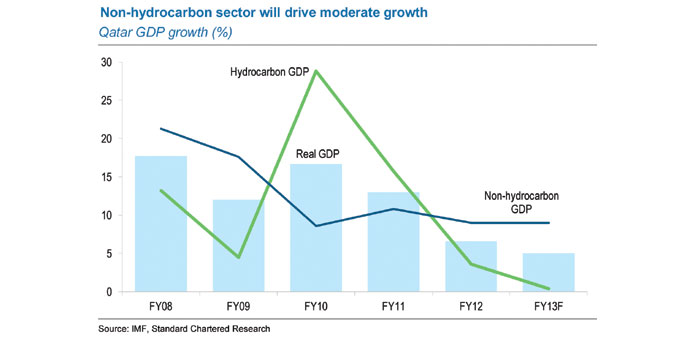

“We expect private-sector growth dynamics to pick up significantly on the back of huge investments in infrastructure projects. We estimate that Qatar’s non-oil sector will grow by 12% in 2013,” StanChart said.

In May, one of the largest projects, the Doha Metro system – worth almost QR30bn ($8bn) was awarded. This was one of the most significant infrastructure projects to be funded in years, and signalled that the government is now shifting its focus to addressing the infrastructure requirements that form part of Doha’s long-term commitments to both FIFA 2022, which the country hosts, and Qatar National Vision (QNV) 2030.

One of the key challenges Qatar has faced over the last two years has been the slower-than-projected level of spending outlays, largely because spending undershot projections. But this is changing and Qatar is now rapidly implementing infrastructure projects.

StanChart says there are clear signs that policy makers are committed to backing wide-scale public-sector projects necessary to support Qatar’s economy in the long run.

“We look at three core themes that will be important to monitor for the remainder of this year. First, we consider what changed in 2013 in terms of spending dynamics, and what this signals. Second, we look at why Vision 2030 as well as FIFA 2022 will be key in driving policy. Third, we look at inflation, and assess how demographic dynamics driven by the current investment boom are increasing housing pressures,” StanChart said.

The bank estimates that almost 85% of the projects in the pipeline are directed towards implementing and delivering on QNV 2030 long-term targets rather than simply focusing on FIFA 2022.

Projects in the pipeline are wide-ranging, from schools, hospitals and other key social infrastructure projects to the Doha Metro and railway projects at an estimated total cost of QR131bn ($36bn).

Therefore, while hosting the World Cup will be an important event for Qatar and the wider region both economically and strategically – being the first sporting event of this scale to be held in the region – Qatar’s legacy will be in delivering world-class infrastructure in line with QNV 2030.

With Qatar already undertaking substantial infrastructure investment, questions remain about whether hosting an event like FIFA 2022 warrants an infrastructure programme of this scale, the report said.

“We think that policy makers in Qatar are pursuing the infrastructure programme in line with the longer-term Qatar National Vision 2030, rather than focusing on a single event. Briefly, QNV 2030 defines the long-term goals for the country as a whole, providing guidance for developing national strategies. A key element in the vision is Qatar must invest too in world class infrastructure to create a dynamic and more diversified economy in which the private sector plays a prominent role,” the report saidProject spending trends in Qatar remains strong in Qatar, says Standard Chartered Bank, which estimates another QR40bn worth key infrastructure projects will be awarded in the country before the year-end.