|

|

Driven by private sector deposits, Qatar recorded the highest money supply growth rate (37.4%) in the region during the first quarter of 2013, QNB has said in a report.

Last year, the country’s money supply growth rate was due to foreign currency deposits.

According to QNB, this reflects a significant shift in trend, compared with the traditional source of money supply growth in Qatar, which may indicate a higher growth contribution from the non-oil sector.

The report said GCC countries continue to have ample liquidity to finance the large investment projects planned over the next few years.

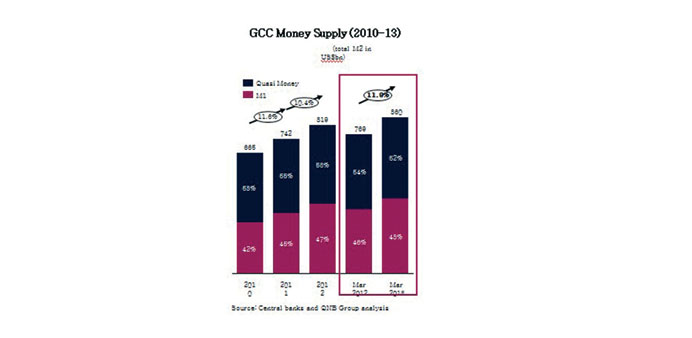

GCC liquidity, as measured by the money supply (M2), increased by 11.9% year-on-year (y-o-y) during the first quarter of 2013 to reach $860bn. This represents a further increase in the growth of M2, compared with 2012 (10.4%).

Higher energy prices and increased hydrocarbons production are feeding through to the non-oil sector through higher liquidity. This higher growth in the GCC money supply enables the private sector to expand economic activity.

The narrower definition of the money supply (M1) in the GCC increased rapidly (16.8%) during the first quarter of 2013, while medium term deposits (quasi-money) went up more moderately (7.7%).

The main reason behind a higher increase in the narrower definition of the money supply is associated with the low interest rate environment that has been prevalent in recent years, which encourages depositors to hold short-term deposits.

Saudi Arabia has the largest money supply in the region, QNB said. Broad money (M2) expanded by 13.4% y-o-y in the kingdom, reflecting a significant increase in demand deposits (18.9%).

Saudi Arabia has a different money supply make up as compared to other GCC countries, with a predominance of short-term deposits. As a result, the narrower definition of the money supply (M1) accounts for three quarters of broad money.

Money Supply growth in the UAE witnessed a major recovery in the first quarter of 2013. Broad money (M2) grew by 4% during the first quarter of 2013.

“This recovery can be attributed to the significant pick up in real estate activity in recent months and the overall gain in investor confidence,” QNB said.

Investment projects planned or currently underway in the GCC are estimated by the Middle East Economic Digest (MEED) at $2.2tn. With huge project financing needs coming up over the next decade, GCC countries will need to further supplement overall bank liquidity with additional sources of funding.

The corporate debt markets have emerged as a good funding option in recent years, the report said.

During the year up to June, debt issuance in the GCC region reached a record level of $34.6bn, compared to $36.6bn in 2012, according to data from Bloomberg.

The GCC countries have also started developing their own domestic debt capital markets as in Qatar.

“These financial developments will widen the overall funding sources for GCC countries to finance non-oil growth, even as domestic banks provide a core source of funding, while reducing the dependence on foreign financing going forward,” QNB said.