By Pratap John/Chief Business Reporter

Indian customers using cheques that are not compliant with Cheque Truncation System (CTS), an online image-based cheque clearing facility, will face delay in clearance from now on, an industry source said.

The country’s central bank – Reserve Bank of India (RBI) - has informed all banks in India that non-compliant CTS cheques need be cleared only thrice a week from January 1.

Reserve Bank of India had earlier set December 31, 2013 as the deadline for issuance of non-CTS cheques.

An Indian banker based in Doha told Gulf Times yesterday that there was no communication yet on “non-clearance” of cheques that are not CTS-compliant.

“But henceforth, non-CTS cheques will be cleared only thrice a week until April. Thereafter the number of weekly clearance sessions will again get reduced. This means those are using this will face delay in instrument clearance,” he said.

He suggested that Indian bank customers should use or deposit CTS-complaint cheques (instruments with CTS India watermark) to avoid delay in clearance.

Considered to be a major milestone in the history of Indian banking, CTS aims to make cheque clearance more efficient and reduce the clearance time of cheques to one day, thereby trimming down the floating time considerably.

A report said India processes more than 1.2bn cheques annually and, therefore, the implementation of this system would drastically cut down the waiting period involved.

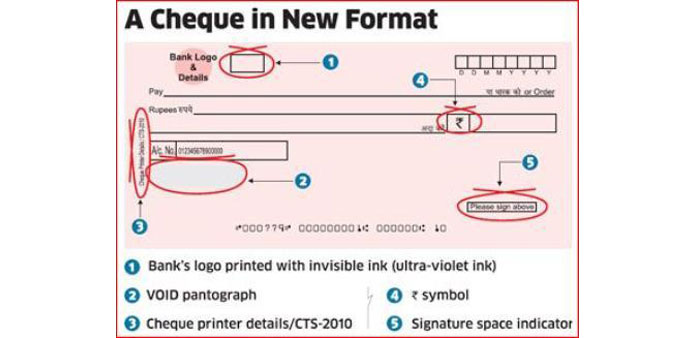

CTS is an online image-based cheque clearing system, wherein, the collecting bank branch would deploy scanned images along with the magnetic ink character of the cheque, which will be sent out electronically using their “capture system”.

The captured images and the data are then signed and encrypted and sent to the clearing house or the central processing location and, thereafter, forwarded to the drawee or paying bank. This helps speed up the cheque collection process, the report said.

Last year, RBI had twice extended the deadline for withdrawal of non-CTS cheques from the clearing system.

In March 2013, the timeline for withdrawal of residual non-CTS-2010 standard cheques was extended up to July 31 last year. Subsequently, time was given until December 31 to withdraw such instruments.

Separate clearing sessions have been introduced in the three CTS centres (Mumbai, Chennai and New Delhi) for clearing non-CTS instruments.

This separate clearing session will initially operate thrice a week (Monday, Wednesday and Friday) up to April 30 this year.

Thereafter, the frequency of such separate sessions will be reduced to twice a week up to October 31 (Monday and Friday) and further to weekly once (every Monday) from November 1, the report said.