By Arno Maierbrugger/Gulf Times Correspondent/Bangkok

The economic integration of the ten-member bloc of the Association of Southeast Asian Nations (Asean) into the Asean Economic Community — expected by the end of 2015 — is seen by financial analysts as a moment that will create large opportunities for Islamic finance in the entire region.

A recent report by Bank Negara Malaysia, the country’s central bank, on Islamic finance expansion in Southeast Asia points out the region’s GDP is expected to grow $3trn by 2017, making it — collectively — the world’s seventh largest economy that allows investors to reach out to a total population of 600mn people, boosting the banking market and highly likely accelerate Islamic finance activity throughout Asean as the outlook for future demand for Shariah-compliant financial services remains bright.

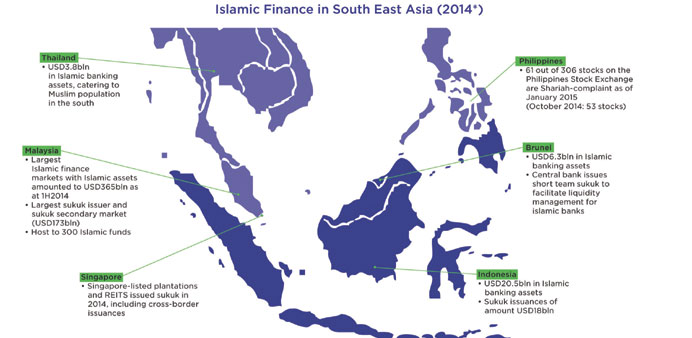

The region has made great efforts since the 1997 Asian financial crisis in developing its money and capital markets and is also in the process of formulating the Asean Banking Integration Framework, which aims to liberalise the Asean banking sector by 2020. As of now, Islamic finance is well developed in Malaysia with total Islamic banking assets of $135bn or one-fifth of the country’s total banking assets, and growing in Indonesia. Especially the latter country, which is home to about 13% of the total global Muslim population, has a large untapped potential for Islamic finance. At $24bn, Islamic banks in Indonesia only held 4.9% of the country’s total banking assets as of 2013, a fact that made Indonesia’s Financial Services Authority decide to launch a five-year roadmap to boost Shariah banking and to streamline regulations.

Other countries, namely Thailand and the Philippines, are catching up particularly in areas where the minority Muslim population demands Shariah-compliant financial services.

The study also identified the key sectors for Islamic finance in Asean. In terms of size, infrastructure including power generation, telecommunication, utilities and construction is expected to utilise $7tn worth of funds in the next 15 years some of which will likely be generated through sukuk issuances. As the majority of Asean nations lag behind OECD standards in terms of roads and railway infrastructure, as well as electricity and clean water supply, governments plan to invest heavily in improving these sectors in the coming years. Bankers expect that many will diversify their funding structure and seek a balance between conventional and Islamic financing of huge projects.

Other important sectors are agriculture including plantations, as well as manufacturing where Islamic financing can support investment and working capital needs of companies. Especially sub sectors like electronics, machinery, vehicles and plastic products represent “relatively untapped potential for Islamic finance, including financing for capital expenditure, working capital and trade financing,” the study finds.

Another trend in the regional sukuk market are cross-border issuances as sukuk issuers venture outside of their home markets to reach out to the large pool of Islamic investors in other parts of the region and beyond. This is where it becomes interesting for Middle East investors to tap into the Asean sukuk market.

According to the International Monetary Fund, global Islamic finance assets have grown at annual double digit rates from $200bn in 2003 to $1.8tn in 2013, and mid-term forecasts for the future potential of this market have reached $4tn. Asset-wise, Iran is the largest market for Shariah-compliant finance worldwide, holding around 43% of global Islamic finance assets, but sanctions are limiting the country’s full participation in the international financial market. Excluding Iran, Malaysia, the UAE, Saudi Arabia, Qatar, Indonesia and Turkey currently represent 78% of international Islamic banking assets.