Reuters

Dubai

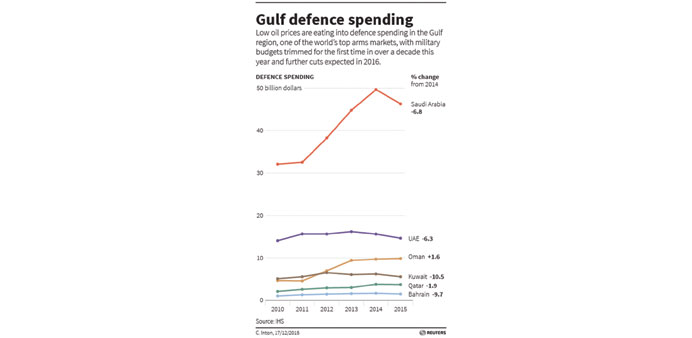

Low oil prices are eating into defence spending in the Gulf region, one of the world’s largest arms markets, with budgets trimmed for the first time in a decade this year and deeper cuts expected in 2016, according to a report published yesterday.

Overall spending fell to $81.6bn in 2015 from $86.7bn last year, London-based global intelligence firm IHS said.

Military spending dropped in Saudi Arabia, Kuwait, Bahrain, Qatar and the UAE, while Oman spent only slightly more, IHS said in the report.

Despite this year’s fall, spending on arms remains substantially higher than four years ago. Gulf states have also built up missile defences.

The security concerns, along with record oil revenues, had propelled the Middle East to become the fastest growing regional weapons market. Gulf spending surged in 2012, up to $71.9bn from $59.1bn in 2010, according to the IHS data.

This year’s cuts come as part of a broad effort to rein in state spending as lower oil prices strain finances in the major oil-exporting countries. Oil prices trade now around $37 a barrel, down from a peak of $115 last year.

The resulting budget constraints mean Gulf states are scaling back buying plans on big-ticket items like warplanes and missile defence, instead focusing on more immediate needs like ammunition.

Led by the Gulf trend, spending in the broader Middle East also dropped in 2015, but is likely to remain largely flat at $170bn over the next two years, the report projected. Saudi Arabia still spends the most on defence in the region, some $46.3bn, accounting for more than half of the Gulf’s military budgets and making it the eighth-largest defence spender in the world, according to IHS.