Building green economies is the solution for sustainable growth, Doha Bank Group CEO Dr R Seetharaman has stressed.

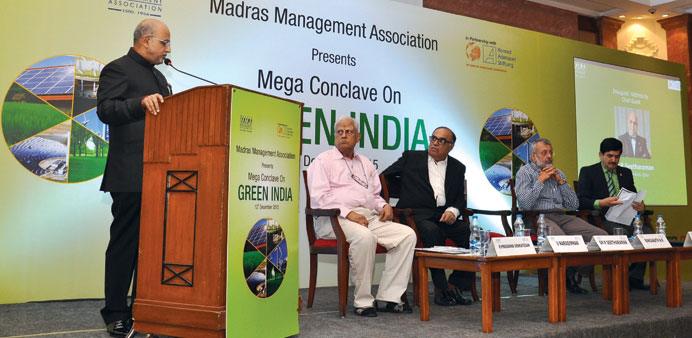

He made the observation while speaking at the Mega Conclave on Green India, hosted by the Madras Management Association in the southern Indian city of Chennai recently.

Leading energy policymakers, energy project developers, environment advisers and bankers participated in the event, where Dr Seetharaman was the chief guest and gave the inaugural address.

Referring to rising global temperatures and the occurrence of cyclones, typhoons and floods in different parts of the world, he said: “These developments once again emphasise that climate change is a global challenge that requires an ambitious global response. A green economy will protect the planet from the worst effects of climate change. Hence, it is necessary that we contribute to the development of a green economy, which is mainly based on sectors such as renewable energy, green buildings, clean transportation, water management, waste management and land management.”

Dr Seetharaman noted that carbon finance, global environmental facility, clean technology fund and feed-in tariff are some of the models for climate change financing. “Carbon finance provides a means of leveraging new private and public investment into projects that reduce greenhouse gas emissions, thereby mitigating climate change while contributing to sustainable development.”

He said greenhouse gas emissions need to be estimated for major economic sectors in areas of operation to determine the carbon footprint, explaining: “Based on the carbon footprint in various economic sectors, different initiatives should be proposed to promote green economies such as lending for green projects, a clean development mechanism scheme and paperless banking.

“The allocation matrix should be such that greater the carbon footprint in the relevant economic sector, the higher the allocation of capital for green banking and sustainable projects. The carbon footprint will be different across various geographies and economic sectors and, hence, country-wise and sector-wise allocations should be explored.

“This forms the basis for green banking and brings prudency into the capital framework. Green banking will encourage green economies and building green economies is the solution for sustainable growth.”

Dr Seetharaman also gave an insight into carbon emission trends and highlighted renewable energy investments. “Global investment in renewable energy was $270.2bn in 2014, nearly 17% higher than the previous year. Investment in developing countries, at $131.3bn, was up 36% on the previous year and the investment for developed economies was at $138.9bn, up just 3% on the year.”

He was also the chairman of the “Green Ideas” session.

Seetharaman addressing the conclave in Chennai.