Reuters

New York

The drilling rigs are gone from the hills surrounding this Pennsylvania town of 30,000. The hotels and bars are quieter too, no longer packed with the workers who flocked in their thousands to America’s newest and biggest gas field.

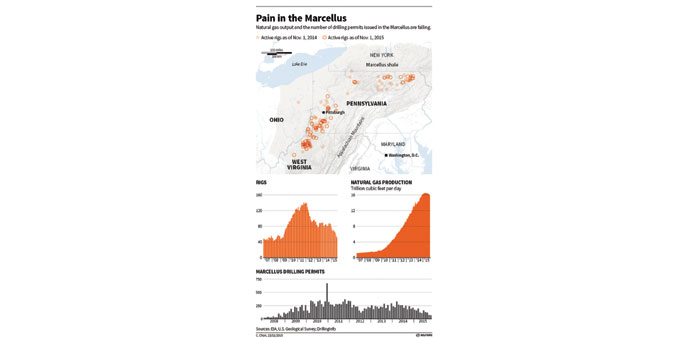

The drilling boom of the past seven years is over, even though thousands of existing wells in the Marcellus region still produce a fifth of US natural gas supply. Now, exclusive data made available to Reuters points to a slump in drilling that could hit production next year, defying government and industry expectations of a further rise in output.

Preliminary figures provided by DrillingInfo, which monitors rig activity, showed drilling permits issued for the 90,000-square mile (233,100 sq km) reservoir beneath Pennsylvania, Ohio, and West Virginia, slumped to 68 in October from 76 in September. There were still 160 permits issued in June and over 600 a month at the peak in 2010.

“The fact that it is slowing and the speed at which it is slowing” sums up the state of US shale gas industry, Allen Gilmer, chief executive officer of DrillingInfo, told Reuters. Recent months are subject to revisions, DrillingInfo said, but a retreat of such magnitude, combined with falling output from older wells, would mark a turning point for the Marcellus - and the whole US gas market.

The Energy Information Administration now forecasts overall US gas output to hit a record in 2016 for the sixth year in a row. A drop in Marcellus production could snap that streak and help prop up prices that have fallen by two thirds since 2010.

US natural gas production has risen 30% since 2008 when the development of hydraulic fracturing, or fracking, and horizontal drilling unlocked vast shale gas reserves, swamping the market with new supply and causing a collapse in prices.

The Marcellus area makes up nearly half of those shale reserves and the government expects the region to keep producing more in the coming years, albeit at a less furious pace.

To be sure, the impact of the slump in drilling permits could be mitigated by other factors. New pipelines coming online in 2016 will allow hundreds of wells already drilled to be hooked up to the grid. A harsh winter could also boost heating demand for natural gas. Still, the retreat could weigh on Marcellus production well into next year, said Grant Nulle, an oil and gas economist at the EIA. “Those are very low numbers,” Nulle said. “It is possible that producers could wait six months to drill after obtaining a permit, which could impact production into May or June,” he added.

An as yet unpublished outlook from the EIA, which does not take into account the permit numbers, anticipates lower Marcellus production only through March, and a rise for the rest of the year. The EIA does not expect a full year’s decline until 2019.

While gas keeps flowing, the drilling crews are gone and with gas prices near 14-year lows, producers have choked hundreds of wells in the region in the hope that falling supply will stem the slide.

Several gas producers, including Chesapeake Energy and Cabot Oil and Gas, have announced production cuts in the region.

Inflection Energy, a Denver-based privately-owned company with an office in Williamsport, has cut production from 50-70% of its wells, company spokesman Matt Henderson said.

“It is better to choke back than to sell into this market,” Henderson said.

NYMEX gas futures have dropped from over $4 permn British thermal units a year ago to just above $2 this week. In the Marcellus region, prices are even lower, touching levels where drilling is uneconomic.

Local energy firms hold out little hope for a near-term rebound, bracing for a longer rough patch instead. Justin Kastner, a manager with Global Land Partners, a company that secures leases for oil and gas companies, said his staff has halved this year from 16 to eight.

“There is just too much gas,” said Kastner. “I expect to see a downturn for the next two years.”

The local economy is feeling the pinch too.

Foreclosure notices filed in Lycoming County, where Williamsport is located, between January and October hit their highest since the data was first collected in 2006, according to Realty Trac.