Reuters

London

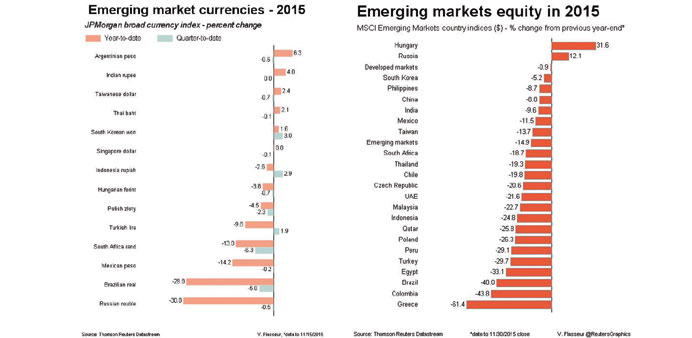

Emerging market stocks achieved their biggest rise in more than a week yesterday, as a weaker dollar eased pressure on developing economy currencies and investors took another set of mixed China data in their stride.

The bulk of the 1.5% gains on MSCI’s emerging market index came from Asia despite surveys showing factory activity deteriorated across much of the region last month and China’s sinking to a three-year low.

Indonesian shares recovered all of the 2.5% they had lost the previous day and Hong Kong and Taiwan bourses both climbed 1.7% as Shanghai also rose 0.7%.

Eastern European and Russian stocks were up for the first rise in three days as a jump in oil and some upbeat regional data helped to gloss over Moscow’s ongoing spat with Turkey over the shooting down of a Russian fighter jet. Hungarian manufacturing purchasing manager data hit its highest of the year, Poland maintained solid momentum while the eurozone, eastern Europe’s big export market, climbed to a 19-month high.

“There is nothing new in the China data today, the PMIs have been weak for some time so I don’t think that is going to surprise anyone,” Jan Dehn at fund manager Ashmore said. “China is going through more reforms than all the rest of the world’s economies put together. When a country goes through that amount of change everyone is going to hold on to their hat and glasses and the economy is going to slow.”

He said that the slowdown was for the right reasons and that the IMF’s approval on Monday to add the yuan to its quasi-currency Special Drawing Rights (SDR) basket underscored the scale of the reforms.

The yuan barely budged as markets digested the well-flagged IMF move and other emerging market currencies were largely steady as they took advantage of a pause in the dollar’s recent rally.

The Indian rupee was a touch weaker at 66.55 per dollar after the central bank left the door open for more rate cuts at a policy meeting. Ukraine’s Hryvnia was testing March lows on nerves about its next IMF loan tranche.

Neighbouring Belarus said it was also discussing a $3bn, 10-year loan at an interest rate of 2.28% with the IMF.

The Russian rouble firmed on higher oil prices and as the country’s central bank moved to ease worries about a potential end-of-year liquidity shortage.

But analysts at Commerzbank warned that the row with Turkey after the downing of a Russian warplane last week could impact the rouble’s performance and that much would depend on what oil prices did after Friday’s Opec meeting.