Indonesia has been caught between the Chinese rock and the Fed’s hard place; QNB said and noted that the country can tackle some domestic issues, which can offset the negative global currents hitting its shores.

The global economy is coming under the influence of two major forces: the slowdown in the Chinese economy and the prospect of monetary tightening in the US, QNB said in an economic commentary. China has been the engine of growth in the global economy in recent years, and its slowdown is having a large effect on a number of its trade partners and commodity prices.

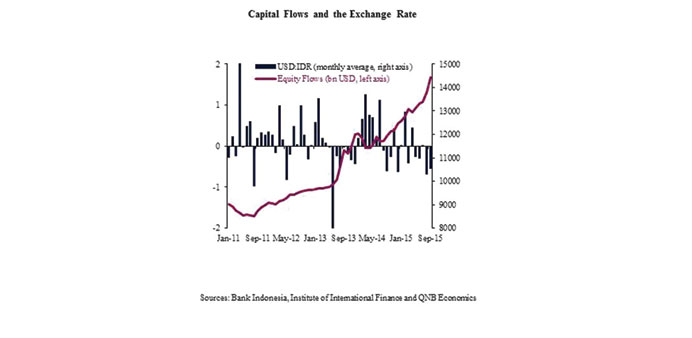

Meanwhile, the US Federal Reserve’s exit from an era of exceptionally easy monetary policy has led to capital flight from emerging markets and increased volatility in asset prices. Perhaps as much as any other country, Indonesia epitomises the power and influence of these two global forces. But its government has started to take some reform measures, which could help it navigate the challenging global environment.

Growth in the Chinese economy has been on a downward trend in recent years, partly reflecting the transition from an investment-led growth model to one driven by consumption, and partly representing a normalisation of the macroeconomic development after many years of breakneck growth rates. China’s slowdown has been a drag on growth in Indonesia due to reduced demand from China for Indonesian exports.

Furthermore, the slowdown in China has had an adverse effect on commodity prices, which are important for Indonesia given that its main exports are commodities such as coal, gas, palm oil and crude oil.

In addition, Indonesia has been impacted by the potential tightening of monetary policy in the US. It has experienced repeated bouts of capital flight since mid-2013, when the Fed announced its intention to taper the quantitative easing programme. The country today is vulnerable to further episodes of capital flight ahead of the expected hike in US interest rates in December.

As a result, the Indonesian rupiah has depreciated by around 50% against the dollar since May 2013. This has hurt economic growth as it reduced the purchasing power of consumers, and as the increase in domestic interest rates aimed at containing capital flight resulted in reduced investment.

Indonesia can do little to influence the external environment. But it can tackle some domestic issues which could offset the negative global currents hitting its shores. Specifically, years of under-investment have meant that the supply bottlenecks are particularly acute and that infrastructure has not kept up with population growth. This is manifested in heavy road traffic, a congested transport network and widespread power and water shortages. It has resulted in sub-par growth, elevated inflation, high interest rates and a loss of competitiveness leading to persistent current account deficits.

The election of Joko Widodo as president in October 2014 has increased hopes of turning the situation around by revitalising investment in infrastructure. So far, the government has taken four measures to step up infrastructure spending. First, it has increased the allocation for investment spending in the state budget by more than $7bn in 2015 and a further 8% in the 2016 draft budget.

Second, it has begun to actually spend these investment allocations after a slow start earlier this year. Third, it introduced legislative reforms to facilitate infrastructure, particularly in relation to land acquisition, which has delayed projects in the past.

Fourth, it has taken steps to encourage private-sector involvement in the infrastructure projects by improving the terms for public-private partnerships in infrastructure.

“The implementation of these measures could offset some of the external headwinds Indonesia is facing, and it could also make it less vulnerable to global shocks in the future. Reducing supply bottlenecks could reduce domestic costs, leading to improved competitiveness for Indonesian producers. This should help reduce Indonesia’s current account deficit and make it less exposed to capital flight. Therefore, conditional on implementation of reforms, we expect real GDP growth to pick up from an expected 4.5% in 2015 to 5% in 2016 and further to 5.5% in 2017,” QNB said.