Reuters

London

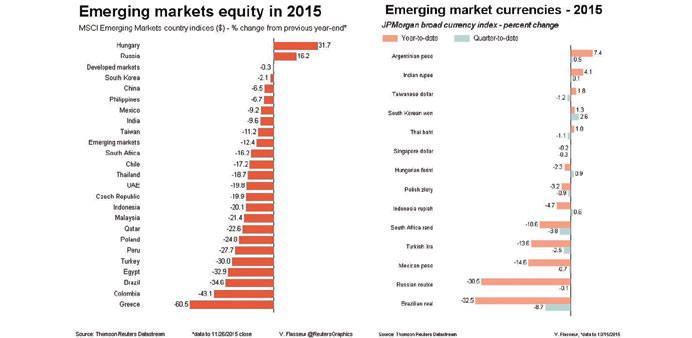

Emerging market assets ended the week on a sour note, with major stocks and currencies chalking up daily and weekly losses as domestic woes were compounded by new worries over the health of the Chinese economy.

MSCI’s broadest emerging market equity index fell 1.2% on the day and was on track for an almost 2% weekly loss.

Chinese mainland stocks tumbled more than 5%, their biggest daily drop since the summer slump, on news that the regulator had widened its probe into brokerages.

Chinese shares had already been fragile, faced with the prospect of a fresh batch of initial public offerings next week and falling industrial profits.

Currencies fared little better, with Russia’s rouble and South Africa’s rand trading around 0.5% weaker against the dollar, while Turkey’s lira slipped 0.2%. All are on track for weekly falls.

Turkish assets have been hammered this week over a stand-off between Moscow and Ankara over the Turkish downing of a Russian warplane.

“The outlook for the lira is quite poor,” said William Jackson at Capital Economics. “Turkey has one of the largest current account deficits in the emerging world, which makes it vulnerable to any slowdown in capital flows, concerns about government authoritarianism, encroachment on central bank independence, and security concerns.”

The lira traded at its weakest in four weeks against the greenback early on Friday and is set to chalk up the steepest weekly losses since March. Istanbul’s main stock index rose 0.5% on the day, but was on track for a weekly drop of almost 7% – the steepest such loss in nearly two years. A firmer US dollar and lower oil prices also weighed on Russian stocks, with rouble-denominated shares down 0.6% on the day and the week. Trading was generally thin, with subdued activity in the US this week due to the Thanksgiving holiday.

Across central and eastern Europe, currencies traded a touch lower against the euro with bourses chalking up solid losses as investors prepared for more monetary easing from the European Central Bank next week.

The Polish zloty eased by 0.1% after hitting its weakest level in three weeks early in the session, on track for its second straight week of losses. Investors remain jittery over Poland’s new government, sworn in last week, which is set to unveil further policy measures.

Stocks in Warsaw slipped 0.6% – a fall matched by bourses in Prague and Budapest, with both Polish and Czech stocks on track for weekly losses.

Fund flows also showed investors’ cautiousness toward emerging assets. While emerging equity funds recorded four straight weeks of outflows, their debt peers saw money leave in 17 out of the past 18 weeks, according to a report by Bank of America Merrill Lynch analysts.

Meanwhile in Zambia, the kwacha strengthened 6% and hit a two month high as a rebound in copper prices and a government pledge to cut spending and support the struggling mining sector soothed investors’ concerns.

The currency of Africa’s second biggest copper producer has fallen more than 40% since the start of the year.