By Arno Maierbrugger

Gulf Times Correspondent

Bangkok

A new report released by ratings agency Standard & Poor’s and the World Bank, Standard and Poor’s Ratings Services Global Financial Literary Survey, shows widespread global inequality in terms of basic financial literacy.

The survey is based on a rather simple five-question list on financial matters such as risk diversification, inflation and compound interest which has been posed to 150,000 adults in more than 140 countries last year. It turned out that two-thirds of people surveyed failed the short test of basic financial concepts.

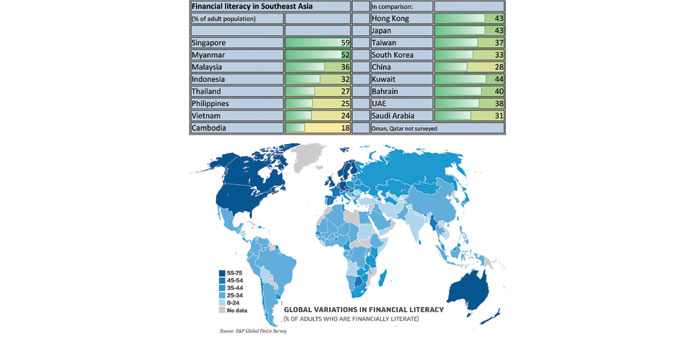

It turned out that countries with the highest financial literacy rates are Australia, Canada, Denmark, Finland, Germany, the Netherlands, Norway, Sweden and the United Kingdom, where about 65% or more of adults are financially literate as per the standards of the test. On the other end of the spectrum, South Asia is home to countries with some of the lowest financial literacy scores, where only a quarter of adults – or fewer – are financially literate. Southeast Asia ended somewhere in between, with the Philippines, Vietnam and Cambodia yielding the worst results, Singapore scoring best and Myanmar’s rank two coming as a bit of a surprise. Gulf Cooperation Council nations, where the survey was made in four out of six countries, were above average.

In contrast, in the major emerging economies – the so-called Brics (Brazil, Russia, India, China and South Africa) – on average, 28% of adults are financially literate. Disparities among these countries range from 24% in India to 42% in South Africa.

The study also points out that financial literacy rates differ in important ways when it comes to characteristics such as gender, education level, income and age. Worldwide, 35% of men are financially literate, compared with 30% of women.

“While women are less likely to provide correct answers to the financial literacy questions, they are also more likely to indicate that they ‘don’t know’ the answer, a finding consistently observed in other studies as well,” the report states.

This gender gap is found in both advanced economies and emerging economies. Women have weaker financial skills than men even considering variations in age, country, education and income.

The study also explains why financial literacy is important, particularly in developing countries.

“Financial ignorance carries significant costs. Consumers who fail to understand the concept of interest compounding spend more on transaction fees, run up bigger debts and incur higher interest rates on loans,” the report says, adding that “they also end up borrowing more and saving less money.”

For example, in developing Southeast Asia, lack of financial literacy provides loan sharks a thriving business. In Thailand, millions of the poorest and most illiterate become prey of unscrupulous and organised black market lenders who cash in up to 20% interest on a small loan – per month. Illegal moneylenders advertise openly to get new customers, for example by distributing flyers in certain communities or posting them somewhere at populous places, with their prime target being people who otherwise have no access to loans and also have no judgement about the extent of usury they are exposed to.

In turn, the potential benefits of financial literacy are manifold. People with strong financial skills do better job planning and saving for retirement. Financially savvy investors are more likely to diversify risk by spreading funds across several ventures.

Governments should be pushing to increase financial inclusion by boosting access to bank accounts and other financial services but, the report recommends. But unless people have the necessary financial skills, these opportunities can easily lead to high debt, mortgage defaults or insolvency, it warns, therefore financial education is should become part of the national curriculum in each

country.