Reuters

London

Turkish shares hit six-week lows yesterday and the lira extended losses on fears that rising tensions with Russia could hurt the already shaky economy.

Other emerging assets were pressured by the dollar’s rise.

Ankara and Moscow have traded words over the downing of a Russian warplane that allegedly violated Turkish airspace and fears are growing that the events will sour multi-billion dollar trade and tourism ties between the countries.

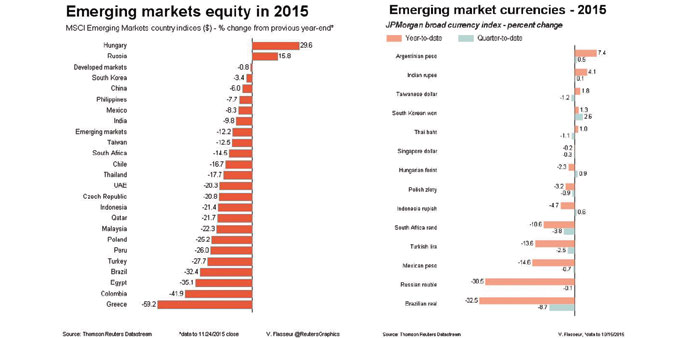

MSCI’s emerging equity index was flat though Chinese shares closed higher as the dollar reversed earlier losses to inch back towards a recent eight-month high against a basket of currencies.

Russian shares gained 0.5% though the rouble slipped 0.4% against the dollar as oil reversed its earlier modest bounce. The impact on Turkish assets has been more pronounced, with fears growing for tourism, construction firms and food exporters which all benefit from Russian business .

Shares in Turkish Airlines slipped to new 2-1/2 month lows while developer Enka with projects in Russia shed 2.7%. Istanbul stocks fell 0.7% at one stage but later recouped some losses, while the lira weakened 0.3%.

SEB analyst Per Hammarlund said: “What we could see is a deterioration in trade relations and diplomatic and economic relations between Turkey and Russia, and Turkey has the most to lose there.”

Investors have also been concerned about the omission of former deputy prime minister Ali Babacan from Turkey’s new cabinet though they have welcomed the appointment of ex-banker Mehmet Simsek to Babacan’s role.

Hammarlund saw the cabinet as “market neutral” but noted Turkey’s gradual move towards an executive presidency centred around President Tayyip Erdogan - meaning economic reforms markets would like to see may not come through.

In central Europe, Polish stocks bounced off 6-1/2-year lows, lifted by strong gains in banks such as Pekao and PKO which have been pressured by fears of a new bank tax and this week’s bankruptcy of the small lender SK Bank.

Hungarian shares rose just 0.2% amid fears for the implications of the central bank’s decision to buy a majority stake in the bourse. Both currencies eased against the euro.

Gulf currencies continued to weaken in forward markets, with the Kuwaiti one-year currency forwards at the lowest in almost seven years versus the dollar. Saudi riyal forwards are already at 12-year lows.

Nigerian 20-year bond yields fell 230 basis points to 10% after Tuesday’s surprise 200 bps rate cut to support growth and the naira fell almost 1% on the unofficial market. Analysts expressed doubts about the efficacy of the move and Nigeria’s reluctance to devalue.

“The decision to ease monetary policy so aggressively is unconventional, in our view, particularly within the context of the challenges the economy is facing....we remain unconvinced that the decision to ease will have the desired impact,” Barclays told clients.