By Arno Maierbrugger

Gulf Times Correspondent

Bangkok

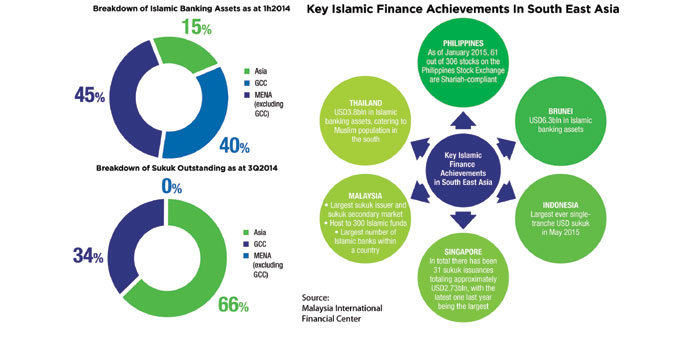

East Asian and Gulf Cooperation Council (GCC) nations will reach combined Islamic finance assets of $770bn by 2018, up from $391.2bn in 2013, mainly driven by Islamic countries in Southeast Asia and continued expansion of the sector into non-Muslim jurisdictions. This will be more than a quarter of estimated global assets of over $3tn by 2018, according to the newly released report “Asia: Future Prospects of Islamic Finance” by Kuala Lumpur-based Malaysia International Financial Centre.

“There are robust growth prospects, unique demographics, strong political support and a large investor base that support the expansion of Islamic finance in Asia. The region’s efforts towards greater integration, including financial integration, provide a solid growth for a strong Islamic financial industry and provide confidence to tout Asia as the future leader for Islamic finance,” the report reads.

By geographical dispersion, expansion has been concentrated in GCC countries and especially Southeast Asia. Discussion on Asia’s growth prospects is fairly entrenched around Southeast Asian Muslim-majority countries such as Malaysia, Indonesia and Brunei with strong growth potential. In Malaysia alone Islamic finance assets are forecast to account for 40% of the banking sector by 2020 while Indonesia, with about 250mn people, is likely to be the next major market for Islamic financing, with its young Islamic banking sector forecast to grow fivefold from 2011 to 2015. Moving to Brunei, the sultanate’s early entry into the Islamic financial services market has provided it with strong foundation to develop the industry and carving out a niche for itself as an international Islamic banking centre.

Recent regulatory efforts were also a positive sign, the report finds, citing enactment of the Islamic Financial Services Act 2013 in Malaysia which went into effect in June 2014 and aims to strengthen the development of Shariah matters in the industry.

In Indonesia, the financial services authority Otoritas Jasa Keuangan (OJK) announced in August 2014 that it was working on a five-year blueprint to develop Islamic finance.

The region’s demand for infrastructure investment of about $60bn a year until 2022 is another driver for Islamic finance, especially for more sukuk issuances by sovereign and government-related entities. Malaysia already contributes two-thirds of the global Islamic debt market, while Indonesia has created a milestone on every global issuance, such as launching an inaugural Wakalah-structure sukuk in 2014 and issuing the largest ever single-tranche US dollar-denominated sukuk in May 2015.

Furthermore, corporate issuers have also tapped the sukuk market to raise funds for the plantation and real estate sector.

But the sector is also expanding into non-Muslim dominated nations. It has a growing presence in countries such as Thailand and the Philippines where the demands for Shariah-compliant financial services for minority Muslim communities are growing.

Elsewhere, Islamic finance also centres on large and populated Asian economies such as China and India, as well as dynamic hotspots such as Singapore, Hong Kong and increasingly Japan. Hong Kong currently readies for becoming a Shariah compliant financing hub for Chinese companies, recently issued its second sovereign sukuk and plans more. Ningxia, an autonomous region in northwest China where a third of the 6.5mn population is Muslim, is preparing to issue a $1.5bn sukuk. The Bombay Stock Exchange became India’s first stock exchange to launch an Islamic-focused index, the S&P BSE 500 Shariah Index. Japan attracted attention in the past with the issuance of a $100mn sukuk al ijarah and by amending its financial regulations to further facilitate Islamic financing. And last, but not least, South Korea’s central bank recently joined Kuala Lumpur-based Islamic Financial Services Board (IFSB), one of the main standard-setting bodies for Islamic finance, to prepare standards for its own Islamic finance industry.