Bloomberg/Oslo

The world’s largest sovereign wealth fund posted its biggest loss in four years, dragged down by Chinese stocks and Volkswagen, just as the Norwegian government prepares to make its first ever withdrawals to plug budget deficits.

The $860bn fund lost 273bn kroner ($32bn) in the third quarter, or 4.9%, the Oslo-based investor said. Its stock holdings declined 8.6%, while it posted a 0.9% gain on bonds and a 3% return on real estate. It was the first back-to-back quarterly loss in six years.

“We have to expect fluctuations in the value of the fund when there are large movements in the market,” said Yngve Slyngstad, its chief executive officer. “With the fund as big as it is today, this can have a considerable impact in the short term. The fund has a long-term horizon, however, and is in a good position to ride out short-term volatility.”

The period was marked by turbulence as worries of a China slowdown and prospects of a US rate increase wiped trillions of dollars off the value of global markets.

The MSCI World Index lost 9% while the MSCI Emerging Markets Index plunged 19% in the quarter. The selloff was exacerbated by a rout in commodities.

The fund had a loss of 21.3% on Chinese stocks in the period and 16.6% on its emerging market equities.

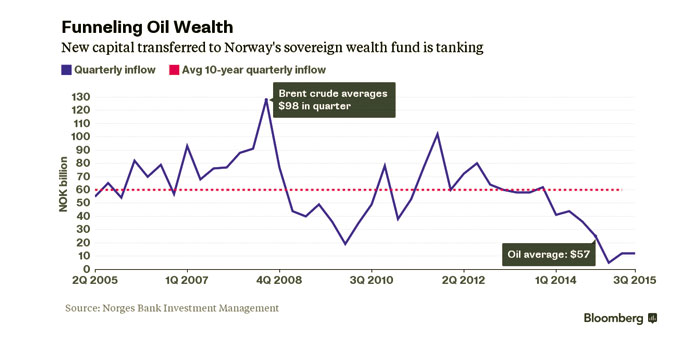

The fund, which has grown more than six-fold amid a boom in oil prices over the past decade, is facing a new era as cash injections may come to a halt as soon as next year.

Budget documents released this month showed the government will withdraw about $440mn next year as it uses up all its direct oil revenue to cushion the economy from a 50% drop in crude prices.

The shift comes as Slyngstad has warned of diminished returns held down by unprecedented monetary easing in the developed world and as the fund is shifting more of its investments to emerging markets and out of Europe.

A plunge in fresh cash for the fund is making that change harder. Inflows from the government were 12bn kroner in the quarter, compared with a 60bn kroner quarterly average over the past 10 years. “That plan needs to be revised based on lower inflows,” Trond Grande, deputy CEO of the fund, said during a press conference. He declined to provide further details about the new plan.

For now, the fund can handle its portfolio adjustments by using cash flow it gets from dividends and bond payments, according to Slyngstad.

“The starting point is to use the cash flow that comes into the fund to readjust the portfolio,” he said in an interview after a press conference. “That means we don’t see any need to reinvest the dividends from European companies into the European market, we would rather buy in equity markets in the rest of the world.”

There won’t be a need to “sell or anything,” he said.

The stock decline in the quarter drove the fund’s stock holdings down to 59.7% from 62.8% in June. Bond holdings rose 37.3% from 34.5% and it held 3% in real estate.

The fund is mandated by the government to hold about 60% in stocks, 35% in debt and 5% in properties.

The fund’s largest stock holding was Nestle and Apple. The biggest bond holdings were in US, Japan and Germany.