By Arno Maierbrugger

Gulf Times Correspondent

Bangkok

The global asset value of Islamic finance, dominated by the Islamic banking sector and the global sukuk market, will expand further at an average annual growth rate of around 17% with total assets projected to come close to $3.5tn by 2018. This is the one of the main messages of a new report by the Organisation of Islamic Cooperation (OIC) and its Standing Committee for Economic and Commercial Cooperation (Comcec) released last week, named “Financial Outlook of the OIC Member Countries 2015.”

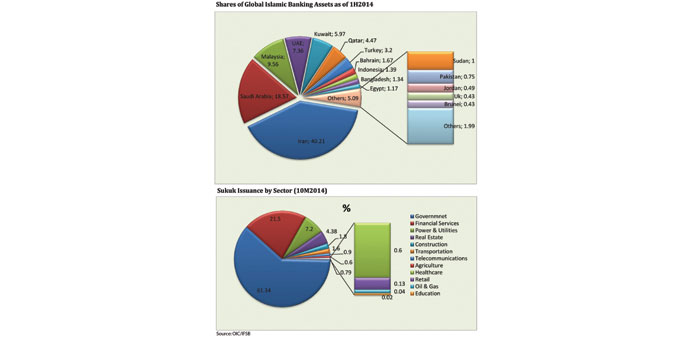

The report noted that Islamic finance assets are spread over most of the OIC’s 57 member states, but mainly concentrated in the Middle East and Southeast Asia. In the first half of 2014, shares of global Islamic banking assets were divided as follows among the top five: Iran (40.21%), Saudi Arabia (18.57%), Malaysia (9.56%), UAE (7.36%) and Kuwait (5.96%). Qatar follows sixth with an asset share of 4.47%.

Other countries with a relatively high share of global Islamic banking assets are Turkey, Bahrain, Indonesia, Bangladesh and Egypt, and as Islamic finance recently made important strides into advanced economies in the West – most notably through Islamic capital market instruments –, the UK made it on the list as the first non-OIC country.

Future increase in the demand for Shariah-compliant assets is particularly seen in Asian markets, namely Malaysia and Indonesia. Islamic banks located in Iran and the Gulf Cooperation Council countries are also expanding operations in Southeast and East Asia, where Singapore and Hong Kong additionally try to entice institutional Islamic investors through various tax incentives.

The report also points out that there has been a “dramatic growth” in the sukuk market in recent years. In each of the last three years up to 2014, annual issuances exceeded $100bn and almost tripled from $45bn in 2011 to $118.8bn in 2014. Malaysia, Saudi Arabia and the UAE, as well as Turkey and Indonesia, were the leading nations, which, in 2014, were supported by the first sukuk issued in the United Kingdom (£200mn issuance), South Africa ($500mn issuance) and Hong Kong ($1bn issuance).

Overall, 53% of sukuk were issued by governments, and 19% by corporations, and the rest on a supra-national level or by government-related entities. Apart from sukuk, Islamic finance asset mainly consist of Islamic funds’ assets and takaful contributions, the report notes.

Future key trends are seen in more debut sovereign sukuk issuances, the expansion of Islamic finance into more countries in Africa and Europe and “more sustainable ecosystems” for Islamic finance in the sense of extended and improved regulation frameworks, as well as supervision by central banks, capital market authorities and takaful regulators.

On the product side, Islamic banks are expected to produce more customised products in order to diversify their offerings and switch to more sophisticated financial services to allow more intense competition with conventional banking and spur the general growth of Islamic banking.

However, the report also expresses certain concerns. Even though the industry has enjoyed impressive growth in the past, ”its sustainability and future growth will largely depend on how successful it is in addressing the challenges at both the macro and micro levels”, the report notes, citing “issues concerning theoretical foundation, financial infrastructure development, systemic implementation, integration with external systems and enhancement of operational efficiency of Islamic finance.”

“If due attention is not paid to addressing these issues, Islamic finance will fail to achieve its full potential and to deliver on its promise. Therefore, the stakes are very high and demand serious discussion of the issues,” the report concludes.