Bloomberg/Hong Kong

Volatility in the world’s wildest stock market is finally receding. If that’s one argument for buying Chinese shares, Bocom International Holdings Co’s Hao Hong has a long list of reasons why you shouldn’t.

For one, the Shanghai Composite Index’s valuation is above its long-term average, even after a 41% drop in the benchmark gauge since mid-June.

Government efforts to bolster the yuan will drain market liquidity, Hong says, and plummeting equity volumes suggest investors lack faith in a rebound. He rejects the notion that targeted economic stimulus is enough to revive the bull market.

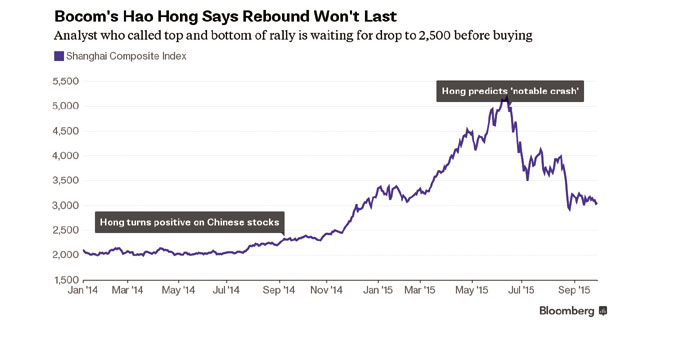

After distinguishing himself as one of the few forecasters to predict both the start and peak of China’s equity boom, Hong is once again breaking ranks with peers as mainland markets resume trading after a week-long holiday.

He says the Shanghai Composite needs to fall 18% to 2,500 before it’s cheap enough to buy, while the average estimate from eight other strategists compiled by Bloomberg implies a 12% rally by year-end.

“I still think it’s better to sell into highs rather than buying dips,” Hong, the chief China strategist at Bocom in Hong Kong, said in an e-mail interview. “The government has succeeded in curbing market volatility. But volume is dying, too.”

Hong turned positive on Chinese stocks in September 2014, saying government support for the market meant it was “time to throw our senses out of the window,” ignore weakening economic data and buy on dips.

The Shanghai Composite more than doubled from the time of his recommendation through its June 12 peak.

In a June 16 interview with Bloomberg Television, Hong said China’s stocks were heading for a “notable crash” after entering a bubble. The equity gauge plunged 40% from that date through its low on August 26.

Even after the rout, the Shanghai Composite is valued at 15.3 times reported earnings, compared with its three-year average of 13.

The median stock in the index, where low-priced banks have some of the biggest weightings, trades at 49 times profit, the highest level among benchmark gauges in the world’s 10 biggest markets.

While volatility in the Shanghai Composite fell to the lowest level in three months before the holiday, the decline has coincided with an 88% drop in turnover from its June peak. The Shanghai gauge rose 3% at the close on Thursday, following gains in overseas markets. The Hang Seng China Enterprises Index, which jumped 11% during the mainland holiday, declined 1%.

The Shanghai Composite will climb to 3,418.75 by year-end, according to the mean of strategist estimates compiled by Bloomberg. For forecasters who provided a price range, the upper target was included in the average.

Further details on government plans to make state-owned enterprises more efficient and increased measures to boost economic growth were among the potential catalysts cited by bulls.

“Although valuations are still not low compared with historic levels, pessimistic expectations have been priced in,” said Zhang Gang, a strategist at Central China Securities Co who expects the Shanghai Composite to rise as high as 3,500 by year-end. “The market might pick up again if reform expectations, which gave support to the bull market, remain intact.”

Declines in margin debt and a reduction of government support for the market will limit gains, said Daniel So, a strategist at CMB International Securities Ltd in Hong Kong.

Leveraged wagers, which helped fuel the rally in the first half of the year, have tumbled by about 60% since the peak, while the number of new investors has fallen more than 80%.

State funds spent $236bn purchasing equities in the three months through August, according to Goldman Sachs Group. “The government won’t intervene actively as long as the Shanghai Composite is at or above current level, i.e. around 3,000,” said So, who has a year-end target of 3,200 for the index. “There is limited room to re-leverage. Demand for margin lending would be low anyway, as it takes time to mend investors’ broken hearts.”

Falling foreign exchange reserves will drain cash from China’s financial system and may cap any gains in equities, Bocom’s Hong said.

China’s stockpile fell by a record in the third quarter as the central bank sold dollars to support the yuan after its August 11 devaluation.

“There will be oversold technical reprieves,” Hong said. Such rallies “can give people a mirage of a new dawn - until they give up hopes of bottom fishing.”