Bloomberg/Hong Kong

International companies that listed shares in Hong Kong to highlight their ties with China are finding what once was a bragging right is now a burden.

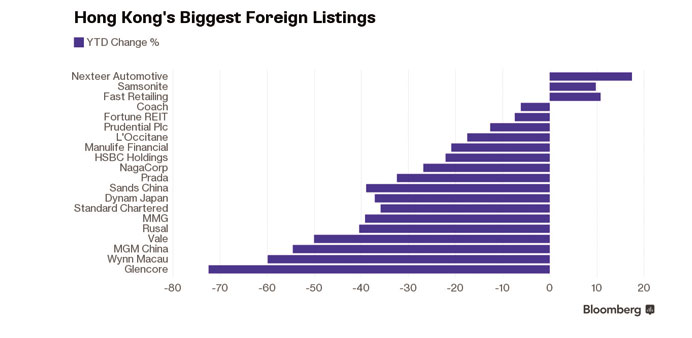

The city’s 20 biggest firms domiciled outside Hong Kong and the mainland dropped an average 27% this year, versus a 12% decline in the Hang Seng Index. Macau casino operators and Prada, an Italian handbag maker, have tumbled as China’s economy slowed and the government discouraged extravagant spending. Glencore, the Swiss commodities group run by Ivan Glasenberg, was down 72% even after a record rally.

Prada and Glencore both gained Hong Kong listings in 2011, when a flurry of overseas companies sold shares in the city to tap investor enthusiasm for what was then the world’s fastest- growing major economy. These days, connections with China are a liability as the country heads for its weakest expansion since 1990. The Hang Seng gauge tumbled 21% in the third quarter, the worst performance among global benchmark indexes outside China and Peru.

“Foreign companies looking to take advantage of Hong Kong’s proximity to China may need to sit tight,” said Bernard Aw, a strategist at IG Asia in Singapore. “Slowing growth and falling Chinese spending, especially on luxury products, will dampen the earnings prospects for companies such as Glencore and Prada.”

Glencore fell 46% last month in Hong Kong, its worst loss on record, amid mounting concern that its debt load will become unsustainable as commodity prices tumble. The rout accelerated last quarter as waning demand from China, the largest consumer of energy and metals, collided with supply gluts in everything from oil to iron ore and nickel.

Russia’s United Co Rusal, the world’s biggest aluminium producer last year, and Brazil’s Vale, the largest iron-ore miner, are also listed in Hong Kong. They’ve slumped at least 40% in 2015.

Prada’s slide has dragged shares of the Milan-based firm 25% below the initial public offering price. Sales of high- end items including jewellery dropped in 17 of the 18 months through July in Hong Kong as a Communist Party campaign against graft and largesse put a damper on cross-border shopping sprees. The six biggest listed Macau casino operators lost half their market value this year through Wednesday, with Wynn Macau sinking 60%.

“With the economy weakening and the anti-corruption clampdown in China, people aren’t spending as much,” said Andrew Clarke, director of trading at Mirabaud Asia, a Hong Kong brokerage. “Macau casinos and luxury-goods businesses have both been affected.”

The Hang Seng Index jumped 3.2% amid optimism about Chinese government support measures for the automotive industry and the property market. Glencore added 7.1%, while Prada slipped 0.2%.

Macau casino operators surged on speculation China may move to support the city’s economy, with Galaxy Entertainment Group jumping 10%.