Bloomberg/Milan

Ferrari’s coveted status as a maker of cars for the super-rich is helping push up its value in an initial public offering to as much as €11bn ($12.4bn), according to people familiar with the matter.

Based on talks with possible investors, Ferrari could be valued from just under €10bn to €11bn when owner Fiat Chrysler Automobiles sells a 10% stake in the division on the New York Stock Exchange, according to the people, who asked not to be identified because the arrangements are private. Fiat shares traded in New York and Milan jumped to an eight-week high.

An IPO price range was expected to be published in an updated filing later yesterday, and presentations to possible buyers are slated for next week, said the people. The valuation may change amid market volatility since Volkswagen’s diesel-testing scandal emerged last month, they said.

Fiat Chrysler chief executive officer Sergio Marchionne, who’s also Ferrari’s chairman, has insisted for months that the brand should be valued as a luxury-goods maker, such as clothiers Prada or Hermes International, and not as an auto manufacturer. Those companies trade at over 20 times operating profit, more than twice the average valuation of car makers.

The Stoxx 600 Automobiles & Parts index of European car makers and suppliers is down about 3% since the September 18 revelation of the Volkswagen emissions-test cheating scandal, recovering partly from a drop of as much as 15% late last month.

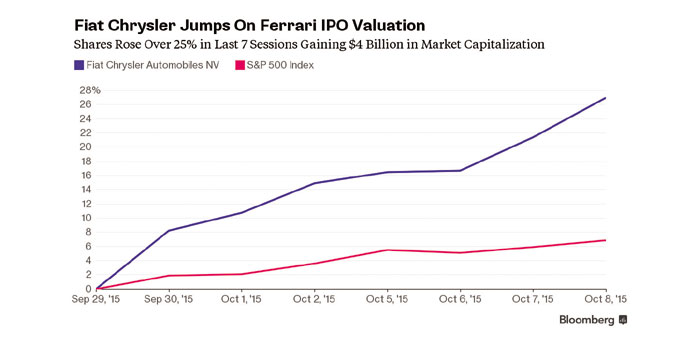

Fiat Chrysler gained as much as 2.6% and was trading up 2.2% at 13.75 euros as of 11:03am in Milan following a jump of 4.6% on Thursday in New York. The car maker has surged more than 25% in New York in the last seven sessions since first details on Ferrari’s valuation were reported, and is at the highest price since mid-August.

“Fiat shares are accelerating following Ferrari’s race to Wall Street,” said Vincenzo Longo, a strategist with IG Group in Milan. “The timing looks right for Ferrari, which waited until the end of the selloff on the market before setting its price range.”

Ferrari may be valued in a range of 12 to 14 times expected 2015 earnings before interest, taxes, depreciation and amortization, one of the people said. Ferrari, which will be listed in New York under the ticker FRRI, posted adjusted Ebitda last year of €693mn after generating a margin of 25% of sales. Profit rose 8.9% in the first half of 2015. Representatives for Fiat Chrysler and Ferrari declined to comment.

“A luxury multiple is justified due to Ferrari’s capital intensity, profit margins at scaled unit production, operating leverage and price inelasticity,” said Adam Wyden, founder of ADW Capital Partners, who owns Fiat Chrysler shares.

Ferrari, which has made a point of restricting sales to preserve its models’ high-end reputation, is set to push the boundaries of its exclusivity with plans to increase production of cars such as the €235,000-Spider convertible to 9,000 cars in 2019 from about 7,200 vehicles last year, according to a September 22 filing. The car maker had previously set its limit at about 7,000 cars a year.

“Ferrari is a legend” because of the value of the brand and its track record on profitability, said Lapo Elkann who, along with his brother, Fiat Chairman John Elkann, is part of the Agnelli family that controls the auto manufacturer. At Ferrari, “you don’t sell a car, you sell a dream,” he said in an interview in Milan.

UBS Group, Bank of America Corp’s Merrill Lynch, Banco Santander, Mediobanca and JPMorgan Chase & Co are advising on the IPO.