Bloomberg/Frankfurt

Downbeat expectations about long-term growth prospects are weighing on the euro-area recovery, European Central Bank Executive Board member Peter Praet said.

“The economic environment is characterised by seeping pessimism about long-term growth,” he said yesterday in Mannheim, Germany. While a cyclical recovery “is progressively taking hold,” the negative stance “holds back a stronger recovery, as uncertainty about the future can feed back into weaker investment today,” he said.

The Frankfurt-based central bank’s attempts to battle anemic price pressures in recent months have stumbled, with the bloc’s inflation rate unexpectedly turning negative in September for the first time since quantitative easing started in March. While declining prices are largely a consequence of lower energy costs, President Mario Draghi has signaled that he stands ready to expand stimulus if needed to avert deflation.

Praet’s comments came as the ECB released an account of its September 2-3 policy meeting in Frankfurt, which showed that officials opted to take more time to understand the driving forces weighing on the economy.

While there was “broad agreement that downside risks to the outlook for inflation had increased,” Draghi “concluded that it remained premature to judge whether recent developments would have a lasting impact on the medium-term outlook,” according to the account.

The uncertain picture was highlighted yesterday by data showing German exports in August slumped the most since the height of the 2009 recession.

“It appeared that the liquidity injected through the Eurosystem’s policy measures had not been distributed evenly across the euro area and was feeding only very slowly into higher demand and activity,” the account shows.

Even though Draghi has said it’s too soon to decide on whether more stimulus is needed, and half the euro-area’s national central bank governors have argued against considering a boost for now, most economists surveyed by Bloomberg last month said more stimulus is on the way.

Two-thirds of respondents said the ECB will add to its €1.1tn ($1.2tn) asset-purchase plan, with a majority of those who gave a timeframe predicting the move will come before the end of the year.

The ECB currently intends to buy €60bn a month of assets including sovereign debt, agency bonds, covered bonds and asset-backed securities through September 2016 to return inflation to its goal of just under 2%. The rate was minus 0.1% in September, and officials predict it averaging just 1.7% in 2017.

“We have always decisively addressed signs of a de- anchoring of inflation expectations,” Praet said in Mannheim.

“Our policy has clearly contributed to stabilising the macroeconomic environment.”

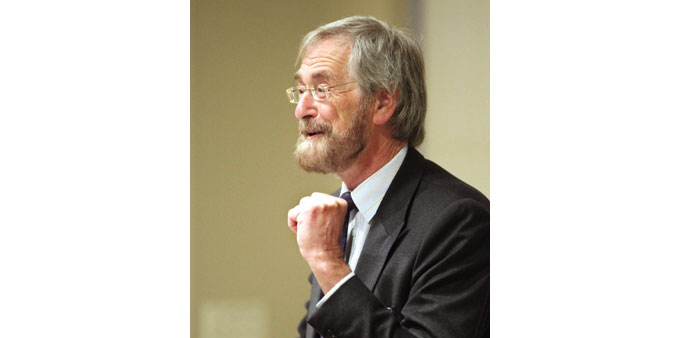

Praet: Sound policies.