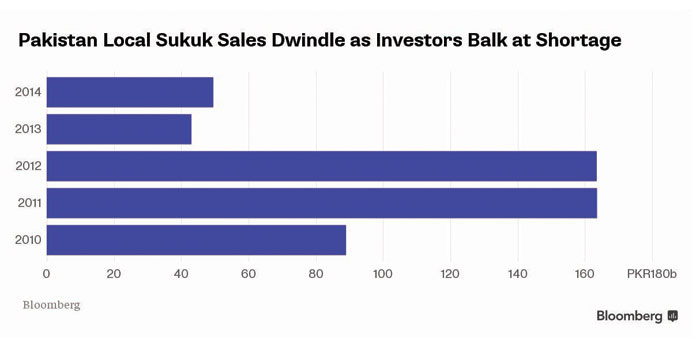

Local-currency Islamic bond sale planned for November; funds say suitable assets to back Shariah debt are lacking

Bloomberg

Kuala Lumpur/Karachi

Shariah-compliant funds in Pakistan say the government’s plan to end a year-long hiatus in local sukuk sales is too little, too late to plug a shortage of assets that has put off their investors.

The finance ministry will sell rupee-denominated sukuk once 233.8bn rupees ($2.2bn) of notes mature on November 21, according to the central bank’s e-mailed reply to questions. That would be the first offering since it raised 49.5bn rupees in June last year. While Pakistan issued global bonds twice in the past 12 months, it has neglected local investors.

“There are a lot of funds sitting idle,” said Sajjad Anwar, Karachi-based chief investment officer at NBP Fullerton Asset Management Ltd, which oversees 46bn rupees. “When the banks and mutual funds don’t have enough instruments to place their funds and generate returns, how can we expect this industry to grow?”

A sovereign credit-rating upgrade in June, record foreign-exchange reserves and a narrowing current-account deficit make it an opportune moment for Prime Minister Nawaz Sharif’s administration to return to the Islamic debt market, after its conventional dollar bond sale in September drew bids for twice the $500mn offered. Shariah-compliant investments in the world’s second-most populous Muslim nation expanded 4% in the quarter ended March from a year earlier, compared with a 28% increase in Islamic banking assets, central bank data show.

“Islamic investors are getting out of our funds and moving to other places such as real estate,” said Vahaj Aslam, a Karachi-based investment manager overseeing 54.2bn rupees at UBL Fund Managers Ltd, whose Al-Ameen Islamic Sovereign Fund has lost 1.7% this year after returning 2.7% in 2014. “Some people are moving to conventional funds or other investment avenues.”

The government plans to also boost funds at lenders by buying back sukuk in open-market operations and confirmation of that is expected in the next few days, Ahmed Ali Siddiqui, head of product development at Meezan Bank Ltd that’s advising the government, said in an October 2 interview from Karachi.

While investors are pushing for more Shariah-compliant instruments to put their cash to work, the government may be struggling to find sufficient assets for the debt, said NBP Fullerton and Faysal Asset Management Ltd. To comply with Shariah law’s ban on interest, Islamic bonds pay returns from underlying assets such as property. Pakistan’s planned securities will be backed by income generated from the Jinnah International Airport, the nation’s biggest, according to the central bank e-mail.

Pakistan uses conventional six-month treasury bills to price its rupee-denominated sukuk, which it has only ever sold in maturities of three years since introducing regulations in 2008. The new notes may be offered at a 50 to 100 basis point yield discount to the shorter-term debt, said NBP Fullerton’s Anwar, who gave the secondary-market bond yield as 4.25% on Monday. The most recent auction of the bills in September garnered an average yield of 6.48%.

“Market appetite will continue to be larger than the issue size and participants will continue to bid at lower yields,” said Vasseh Ahmed, chief investment officer of Karachi-based Faysal Asset that oversees 9.4bn rupees.

The South Asian nation is tapping domestic and international investors just as its economic prospects are brightening. Pakistan, whose $247bn economy has been plagued by blackouts and a terrorist insurgency, saw foreign-exchange reserves surpass $20bn for the first time last week, according to a finance ministry statement. Islamic banking assets rose to 1.3tn rupees in the first quarter, while net investment increased to 368bn rupees, data show from the State Bank of Pakistan.

Moody’s Investors Service upgraded the sovereign rating by one level to B3 in June, the sixth-lowest junk score, citing improving reserves and an economic overhaul under an International Monetary Fund programme. Standard & Poor’s raised the outlook on its B- rating to positive from stable in May. The current-account deficit narrowed to $219mn in August from $175mn a year earlier and amounted to 0.9% of gross domestic product compared with 0.7%, according to a September central bank statement.

“Why would Islamic banks want deposits when they can’t invest in any assets?” asked Faizan Saleem, fund manager at ABL Asset Management Co in Karachi that oversees 28bn rupees. “Things are really bad.”