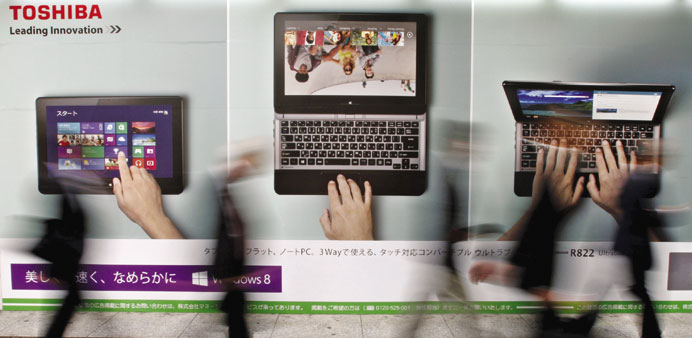

Passersby walk past an advertisement for Toshiba outside an electronic store in Tokyo. The Japanese firm’s second postponement of its annual results due to newfound accounting errors should be met with a tough response from regulators, Japanese lawmakers urged on Wednesday.

Reuters/Tokyo

Japanese lawmakers yesterday called for a tough regulatory response to Toshiba Corp’s second postponement of its annual results over accounting woes, saying the scandal could erode foreign investor confidence.

Regulators are likely to penalise the laptop-to-nuclear power conglomerate with a fine after an independent probe found that the company had overstated past results by $1.2bn over several years, sources familiar with matter have said.

Japan’s regulators are, however, often perceived as softer than Western counterparts when punishing corporate misdeeds. “The scandal is a severe problem that could lead to a loss of credibility from foreign investors”, Masahiko Shibayama, head of the Liberal Democratic Party’s treasury and finance division, told reporters after a meeting of lawmakers and regulators.

The Tokyo Stock Exchange would consider putting Toshiba’s shares on a watchlist for possible delisting if there were further delays in reporting results, Shibayama quoted a bourse official as saying in the meeting.

Forced delistings are, however, rare. Kazuhiko Toyama, who advised the government on new corporate governance guidelines that seek to improve shareholder returns, said a delisting would not be the answer.

“The exchange should not delist Toshiba because the direct victims of a delisting would be the shareholders and not the company,” he told a news briefing on corporate governance. The accounting scandal is Japan’s biggest since 2011 when camera and medical device maker Olympus Corp was found to be involved in a $1.7bn scheme to conceal two decades of investment losses. Olympus was subsequently fined 700mn yen ($5.8mn) and some former executives were handed suspended jail sentences.

Toshiba put off plans to announce annual results on Monday, citing newfound accounting errors, receiving a government extension to submit them by Sept. 7. It said the new errors were not huge.

Shares in the sprawling conglomerate have tumbled more than 30% since it disclosed in April a probe into its past book-keeping practices, giving it a current market value of some $12.3bn.