Bloomberg/New York

A ten-day drought in corporate bond sales is worsening a backlog of US companies that need to raise debt to fund takeovers as borrowing costs rise.

High-grade companies have retreated from debt markets as concern that China’s slowdown is hampering global growth roils investors.

Investors pulled $1.99bn from mutual funds that buy investment-grade debt last week, the biggest withdrawal in two years, according to Lipper.

“The lack of issuance in August relative to the pipeline tells you that the market finally has shown some signs of nervousness,” said David Ader, the head of strategy at CRT Capital Group.

“I have no doubt that issuance will come back to the market - the question is at what level people will want to bring it.”

While bond sales tends to slow during the summer vacation period in the US, the pause this year means less time to lock in low borrowing costs for companies that plan to finance mergers before the Federal Reserve boosts interest rates for the first time since 2006.

Barclays estimates US companies still need to sell about $95bn of bonds in 2015 to pay for acquisitions.

Borrowers include Halliburton Co, which may need $8.6bn to finance its takeover of Baker Hughes and Frontier Communications Corp, which plans to raise$6bn in the debt markets to buy assets from Verizon Communications.

Companies have issued about $189bn of bonds to finance mergers this year, according to Barclays.

In July alone Charter Communications raised$15.5bn in the bond market to partially finance its buyout of Time Warner Cable, while CVS Health Corp sold$15bn of debt to purchase Omnicare and Target Corp’s pharmacies and clinics.

“A lot of issuers took advantage of the good environment earlier in the year to get their financing done,” said Mark Bamford, the New York-based head of global fixed-income syndicate at Barclays.

Corporate-bond issuance declined by 60% in August from the previous month as investors reined in demand for riskier securities after news of a deepening slowdown in China, Bloomberg data show.

“We don’t know yet what impact the volatility has had on issuance,” said Bamford.

“This has all occurred in a month when a lot of issuers and investors are away and not prepared to make major decisions.”

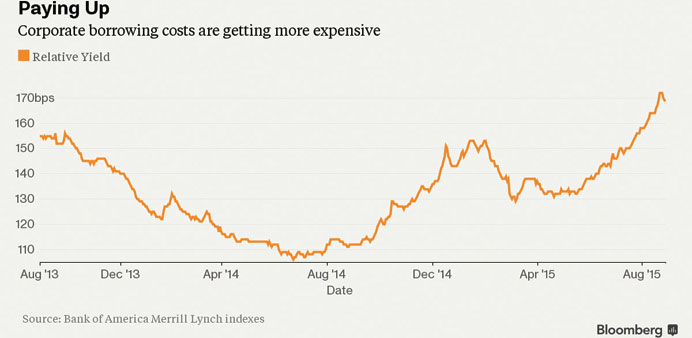

But the impact on borrowing costs is clear: they have gone up.

The extra yield investors demand to hold investment-grade company bonds over government debt rose last week rose to 1.72 percentage points, the highest in more than two years, according to Bank of America Merrill Lynch Indexes.

“At least 22 names still have funding to do before the end of the year,” said Richard Wolff, the co-head of US bond syndicate at Societe Generale in New York.

“It will be more challenging for issuers to navigate. But it won’t stop.”