Reuters/London

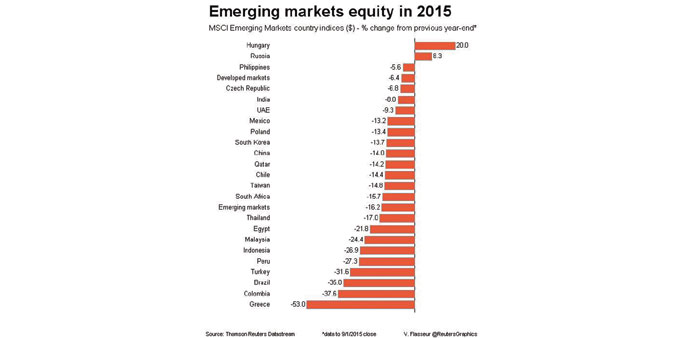

Emerging equities fell for the third day running yesterday, approaching six-year lows on deepening concerns about global growth, as oil price weakness fuelled another drop in the Russian rouble.

Data this week showed manufacturing and exports contracted in several emerging economies. Chinese output contracted in August at the sharpest pace in three years while European and US growth also eased. That has kept emerging assets close to multi-year or record lows.

Chinese mainland shares bounced off early losses after a range of brokerages pledged additional funds to buy shares while Hong Kong shares fell 1%. The benchmark emerging equity index slipped 0.4%.

“The Chinese problems are not yet solved and the US Fed rate hike is still in the pipe, so we don’t expect any meaningful and sustainable rally in emerging markets in the short term,” said Sebastien Barbe, head of emerging currency and debt strategy at Credit Agricole in Paris.

Russian assets took a knock from oil’s sharp price reversal, with shares down half a% and the rouble extending Tuesday’s 3.8% fall, its biggest one-day loss in three months. The currency fell 0.9% to the dollar .

The Turkish lira traded at a one-week low against the dollar but equities recovered half a%. Shares in conglomerate Koza Ipek rose 3% following steep declines on Tuesday when police raided the company which is believed linked to dissident cleric Fethullah Gulen .

Barbe said Turkey, with South Africa and Brazil, was among the most vulnerable emerging currencies due to its big current account deficit.

“There could be some central bank support for currencies as they try to avoid the loss of control of the exchange rates, but ... a lot of central banks will be tempted to let their currencies depreciate as global growth is tepid, and global trade is going nowhere,” he added.

Brazil, which has raised interest rates by 325 basis points over nine months is set to end that cycle later on Wednesday at a central bank meeting. The real has fallen almost 30% this year and is near 13-year lows.

Central European assets stayed rangebound at weaker levels following this week’s data that revealed a plunge in Polish manufacturing and weakness in Hungary.

The Czech crown however stayed close to its 27-per-euro exchange rate cap around which the central bank tends to buy euros. Central bank deputy governor Vladimir Tomsik said loose monetary policy may be needed for longer than expected.