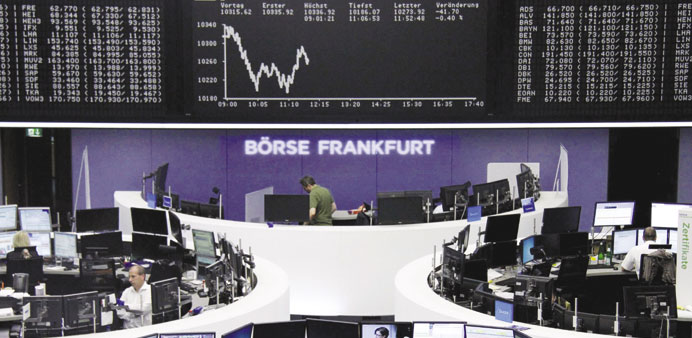

Traders work in front of the DAX board at the Frankfurt Stock Exchange yesterday. The DAX 30 index slipped 0.17% yesterday as investors remained cautious.

AFP/London

Global stock markets finished mixed yesterday at the end of a turbulent week driven by worries over China’s slowing growth with some relief coming from data showing the strength of the US economy.

In Europe, London’s benchmark FTSE 100 index closed up 0.90% and the CAC 40 rose 0.36%. But Frankfurt’s DAX 30 index slipped 0.17% as investors remained cautious after a yo-yo week of trading.

In London foreign exchange deals yesterday, the euro slipped to $1.1170 from $1.1239 late on Thursday.

After collapsing on Monday to levels last seen during the 2008 global financial crisis, oil prices rallied by the end of the week with Brent North Sea crude for October delivery at $47.20 a barrel and West Texas Intermediate (WTI) gaining to $42.03 a barrel.

Eyes now turn to a central banking symposium that the US Federal Reserve is hosting in Jackson Hole, Wyoming, which lasts until today.

Investors hope for an indication as to whether the US central bank believes the global turmoil is severe enough to delay a long-expected hike in interest rates.

On Wednesday, New York Federal Reserve head William Dudley said the Chinese turmoil had made the arguments for a rate rise in September “less compelling.”

IG Markets analyst Angus Nicholson cautioned that “there still does not seem to be the macro foundations for indices to fully recover from their corrections, as concerns over China and uncertainty over Fed rate hikes continue to linger.”

Federal Reserve Vice Chair Stanley Fischer said yesterday that no decision had been made yet on raising interest rates at the US central bank’s September 16-17 policy meeting.

“The change in the circumstances which began with the Chinese devaluation is relatively new and we are still watching how it unfolds. So I wouldn’t want to go ahead and decide right now,” Fischer told CNBC television in an interview.

Wall Street equities were also trading mixed around midday yesterday, with the Dow Jones Industrial Average 0.40% lower, the broad-based S&P 500 down 0.13%, while the tech-rich Nasdaq Composite Index was up a slight 0.03%.

Chris Green, an Auckland-based strategist at First NZ Capital, said the figures showed the US economy was in better shape.

Thursday’s data, which showed the world’s biggest economy grew at an annual rate of 3.7% in the April-June quarter, buoyed markets that have been worried over the faltering Chinese economy, which accounts for some 13% of global output.

The latest data boosted the dollar, though caution crept in yesterday.