By Arno Maierbrugger/Gulf Times Correspondent /Bangkok

With the Asean Economic Community (AEC), the envisaged economic union of the Association of Southeast Asian countries (Asean), approaching and member countries eagerly competing for foreign direct investment and regional headquarters of foreign firms, time has come to take a look at the current tax regimes in Asean countries.

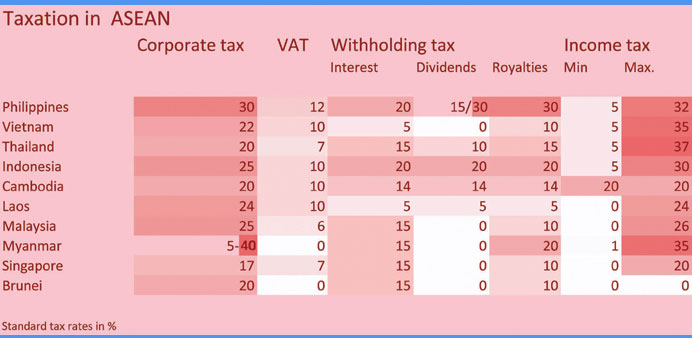

Taking a mix of corporate tax, value added tax, withholding taxes and personal income tax as per general tax rates (not taking into account tax incentives offered to foreign firms or investors), it turns out that Vietnam has some of the highest taxes in the region, which puts a big burden on businesses, especially small and medium ones.

Vietnamese economists claim that the ratio of taxes and fees every Vietnamese has to bear in relation to GDP is 1.4 to 3 times higher than in other regional countries, a notion that, however, has been rejected by the government. But according to Tran Dinh Thien, head of the Vietnam Economics Institute, this is indeed the case despite most categories of taxes have been cut recently. At least, Vietnam is one of a number of countries in the region that is lowering taxes for businesses.

The corporate income tax, for example, has been cut from 32% to 22% in the recent past and will be cut further to 20% by 2016.

However, Filipinos are joining the same chorus, saying that actually they are the ones paying the highest taxes in Asean, at least according to the Tax Management Association of the Philippines which claims this is a result of fixed tax brackets that do not adjust for inflation, as well as poor tax administration.

And it seems that there is really no consolation for Filipinos here. Corporate taxes are very high at 30%, exceeding all Asean member countries as well as the global and Asia averages, except Myanmar which collects a whopping 40%, but only from non-resident companies while others start at a 5% tax rate.

While in the Philippines the value added tax rate is lower than the global or Asia averages, it is still higher than in any other Asean member state. Furthermore, withholding taxes on interest, dividends and royalties are also highest.

Other high-tax jurisdictions in the region are Thailand and Indonesia. The World Bank says that Thailand’s taxes are fifth-highest in Asean and 153rd out of 180 countries globally. However, corporate taxation of 20% is comparably moderate, and in its quest for more foreign direct investment, the Thai Board of Investment has recently introduced two new programmes, the International Headquarter Programme (IHQ) and the International Trading Centre Programme (ITC).While the corporate income tax for both programmes remains at 10% for Thailand-based businesses and at 0% for foreign affiliates, foreign staff has now been exempted from personal income tax and interest payments to affiliates from business tax.

Indonesia, although it has already high tax rates, wants to increase tax revenue by 30% in 2015, a move that includes improved tax collection efforts and import taxes on consumer goods to be raised between 10% and 150%, while the country has, however, exempted most goods from a so-called luxury tax in a bid to boost household consumption and revive faltering economic growth. Buyers of electrical appliances, sports equipment, musical instruments and branded goods will no longer be required to pay luxury tax, but will still have to pay value-added tax. Previously, the government imposed a luxury tax of up to 75%.

It still applies luxury tax to expensive cars, yachts, aircrafts, guns, certain beverages and larger properties. For corporations, Indonesia has just recently revised the government’s tax holiday policy in order to attract more investors to enter the country’s strategic industries.

On the other side of the spectrum, Singapore and Brunei remain Asean’s tax havens for individuals and corporations.

However, the great differences in taxation between Asean countries has already led to numerous disputes as a result of a lack of progress in regional tax policy coordination, a topic that remains a very hot one ahead of the AEC integration.