Reuters/London

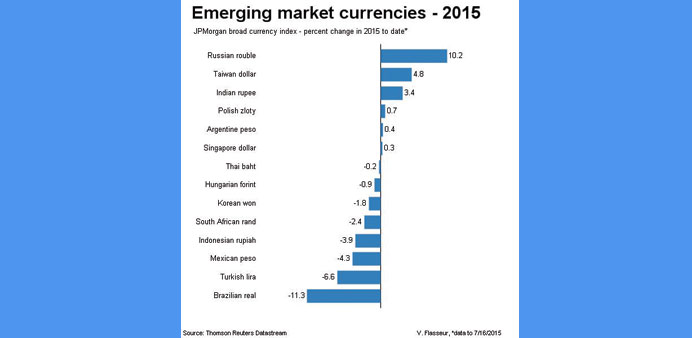

Emerging market currencies strengthened yesterday, getting help from a weaker dollar. A small bounce in oil prices boosted the Russian rouble.

The rouble rose 1% off five-month lows against the dollar as oil prices rose a similar amount after a 5% drop yesterday.

South Africa’s rand and Turkey’s lira both gained around half a% as the dollar index weakened 0.2%.

Asian currencies also strengthened, following the Australian dollar after the central bank left interest rates unchanged but dropped its usual reference to a further decline in the currency being necessary.

“In emerging markets broadly, there are bottom-up issues such as concerns about Chinese growth and the crisis in Russia, but top-down, the argument is about commodity prices, which are at multi-year lows – whether oil or copper,” said Thomas Harr, head of research at Danske bank in Copenhagen.

MSCI’s broadest emerging market stock index traded higher while mainland China indexes closed up as much as 3.7% after Beijing ramped up its crackdown on short-selling.

China’s regulator introduced rules making it harder for speculators to profit from hourly price changes and some of the nation’s major brokerages suspended their short-selling businesses.

The Athens index lost 2.5% after diving 16% on Monday, when it reopened after being closed for five weeks. But some non-financial stocks rose in early trade.

Polish, Hungarian and Czech stocks all losing ground after solid economic data boosted them in the previous session .

Romanian stocks rose 0.5% as investors awaited the outcome of a central bank meeting that is likely to keep rates at a record low 1.75%. Many expect rates to remain at that level through the first quarter of 2016.

The Polish central bank finished cutting rates in March and Hungary ended cuts last month, as expectations grew that the US Federal Reserve will start to raise rates later this year.

Currencies across the region were little changed against the euro. The Czech crown reached 27.02 to the euro, near the central bank’s cap on its value of “close to” 27 per euro.