Reuters/Bangkok

Thai property developers are raising record funds in the domestic bond market to finance high-end residential projects in a stumbling economy that appears to have hurt all but the affluent.

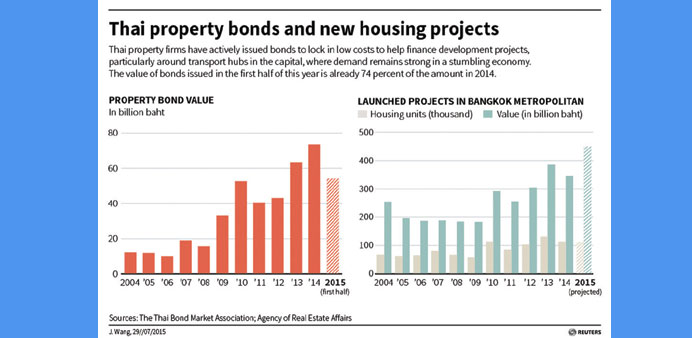

Developers issued 54.2bn baht ($1.55bn) of bonds in the first half of this year – a record for a six-month period and equal to 74% of the debt sold by developers for the whole of 2014, according to the Thai Bond Market Association.

Raising funds from the debt market is much cheaper than bank loans despite the two cuts in the central bank’s policy rate so far this year. A sluggish economy has turned banks cautious about lending. Prime lending rates are at least 6.5%, compared with the 3.31% coupon on five-year bonds issued this year by Land & Houses, Thailand’s largest home builder. Real estate developers are also loath to raise funds in a weak stock market.

But wealthy Thais seem to be unperturbed by the economic woes, playing the role of white knight in an uncertain property market. Their purchases in Bangkok have gravitated towards developments near future transport nodes and hubs. Skytrain operator BTS Group and developer Sansiri said this month they would jointly develop 25 condominium projects worth 100bn baht along mass transit lines over the next five years.

In Greater Bangkok, the value of new housing projects rose 64% in January-to-June to 227bn baht from a year earlier, and is expected to climb to 449bn baht for the full 2015, according to the Agency for Real Estate Affairs. The agency expects the market value of new premium units to surge 281% this year versus zero growth for cheaper units. “We have also switched to the high-end market,” said Kessara Thanyalakpark, director of Thai property firm Sena Development . “Others probably think the same, as household debt is quite a problem for the lower segment of the market,” she said.