By Arno Maierbrugger

Gulf Times Correspondent

Bangkok

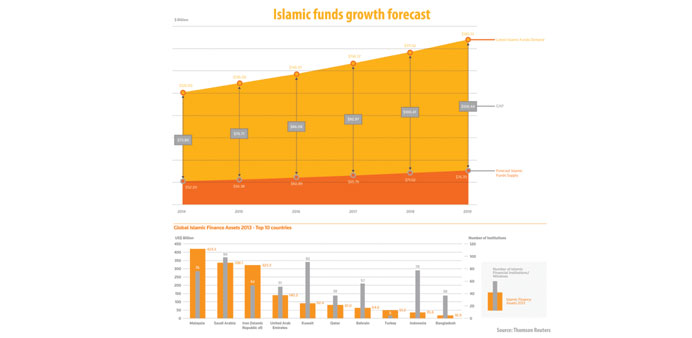

Islamic wealth management is going to become be the “new frontier” for the global Islamic finance industry as a growing number of Islamic high-net worth individuals keeps looking for Shariah-compliant types of investment. According to Thomson Reuters’ Global Islamic Asset Management Outlook 2015, Islamic funds – which are already a $60bn industry – are forecast to grow to at least $77bn by 2019, but the latent demand for Islamic funds is projected to grow even higher to $185bn, highlighting “substantial growth opportunities” for an industry that is supposed to struggle to reach its potential in the near- to mid-term to bridge the $108bn demand-supply gap.

As per figures of the Kuala Lumpur-based Islamic Financial Services Board, Islamic finance assets are heavily concentrated in the Middle East and Asia, with the Gulf Cooperation Council (GCC) countries accounting for the largest proportion of Islamic financial assets with 37.6% of the global total. The Middle East and North Africa region (ex-GCC) ranks a close second with a 34.4% share owing to Iran’s large Shariah-compliant banking sector. Asia ranks third, representing a 22.4% share in the global total, largely spearheaded by the Malaysian Islamic finance marketplace.

Initially, Europe led the initial drive of Islamic wealth management through financial institutions such as BNP Paribas, UBS and Geneva-based Dar al Maal al Islami – which currently has $3.6bn of assets under management –, but now other Shariah-based players have joined the market, especially in the GCC and Southeast Asia.

“The key areas of opportunity available to the Islamic asset management industry are Islamic wealth management, private equity, crowd funding, sustainable investing and socially responsible investments,” says Nadim Najjar, managing director, Middle East and North Africa with Thomson Reuters, adding that “almost 70% of Middle Eastern wealth is transferred overseas. To attract this wealth, Islamic asset managers need to compete with institutions overseas by providing both attractive yields and a superior level of service quality and product customisation.”

Among Islamic wealth management products, sukuk, selected Shariah-compliant equities, fixed income assets and real estate remain the most popular types of investment. For investors wanting to have more choices, there is a need to have diverse issuers and issuances with differing terms, e.g. different tenors, different yields and different structures using underlying Shariah principles. Other investment types, such as structured notes, index tracking funds and exchange traded funds are new to the Islamic finance market and rather hard to find, but product diversity in the sector is growing as both Muslim and non-Muslim investors are increasingly interested to invest surplus funds in a Shariah-compliant manner, thus triggering development of new and more sophisticated Islamic investment products and motivating Islamic financial engineering.

According to Thomson Reuters, in 2014, 84% of total Islamic assets under management were held in eight countries, with Saudi Arabia and Malaysia accounting for 69% of the total. Outside of the GCC and Malaysia, the industry continues to work within a partly unsupportive regulatory framework, suffering from a lack of government support and absence of clear Shariah-compliant investment avenues. But there are indeed growth markets on the horizon for Islamic funds. Pakistan and Indonesia currently enjoy stable political climates and are undertaking efforts to expand their Islamic finance industries across all sectors, and China – via Hong Kong - is also opening up to Shariah-compliant funds for retail clients, both developments that help diversify the industry away from its heavy concentration in a few core markets.