Qatar’s diversification drive is expected to continue even as the non-hydrocarbon sector is set to increase its share of the gross domestic product (GDP), QNB has said in a report.

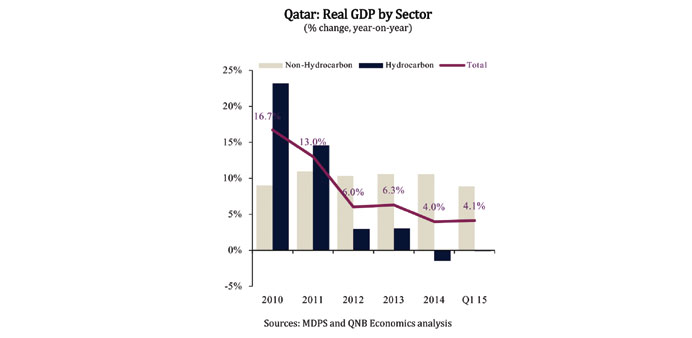

Qatar’s economy registered “another strong performance” in the first quarter of 2015, growing by 4.1% year-on-year, QNB said quoting the latest data from the Ministry of Development Planning and Statistics (MDPS).

Growth was spurred by the strong expansion in the non-hydrocarbon sector. Hydrocarbon production, meanwhile, remained broadly stable.

“The latest data are evidence to Qatar’s ongoing process of economic diversification away from its traditional role as a hydrocarbon exporter. Strong macroeconomic fundamentals provide the economy with the necessary buffers to withstand the impact of lower oil prices,” QNB said.

The non-hydrocarbon sector continues to be the growth engine of the economy, expanding by 8.9% year-on-year in Q1, 2015.

The largest contributors to real non-hydrocarbon growth were construction, financial services and manufacturing.

Construction activity increased 11.4% year-on-year as large scale infrastructure projects remain the main driver of economic activity in Qatar. Such projects include the new Doha metro, real estate projects such as Musheireb in the centre of Doha and Lusail to the north, as well as new roads, highways and the further expansion of the Hamad International Airport.

The implementation of infrastructure projects is attracting a large influx of expatriates, with population growing by 10.0% in Q1, 2015 over a year earlier.

Rapid population growth is stimulating growth in the services sector like financial services (with annual growth rate of 9.8% in Q1), trade, hotels and restaurants (9.3%) and government services (5.8%).

As well as the “horizontal diversification” away from hydrocarbons, Qatar is also undergoing a “vertical diversification” process, QNB said. This is reflected in the expansion in refinery and petrochemical activities to move up the hydrocarbon value chain. The strong growth in manufacturing (9%) is a confirmation of this type of diversification.

On the other hand, the hydrocarbon sector, which consists of crude oil and raw gas production, contracted by 0.1% year-on-year in Q1, 2015 as a result of lower crude oil output as well as shutdowns for maintenance at gas facilities.

“However, we expect the hydrocarbon sector to recover in the medium term, as gas production is expected to increase due to the Barzan gas project coming on stream while crude oil and condensate production is forecast to remain stable” QNB said.

The MDPS has rebased the GDP series to a new base year, 2013 (previously 2004). GDP is typically measured by reference to the structure of the economy in a “base” year.

The weight given to each sector depends on its importance to the economy in the base year. Qatar’s old GDP data relied on a snapshot of its economy in 2004. The structure of the economy has evolved since then, and therefore, the base year was updated to 2013.

As a result, the share of the hydrocarbon sector in real GDP has increased, reflecting higher oil prices in 2013 compared to 2004. As rebasing has increased the weight of the slower-growing sector (hydrocarbons) in GDP at the expense of the faster-growing sector (non-hydrocarbons), growth in 2014 was revised down to 4% from 6.1% before rebasing.

“Overall, we expect the diversification drive to continue and for the non-hydrocarbon sector to increase its share of GDP. Low inflation, healthy fiscal balances and significant current account surpluses should provide a conducive macroeconomic environment for the growth momentum to continue gathering steam,” QNB said.