Reuters/London

Emerging market stocks fell for a fifth straight day yesterday, reaching a six-month low, as China’s troubled bourses continued to slide.

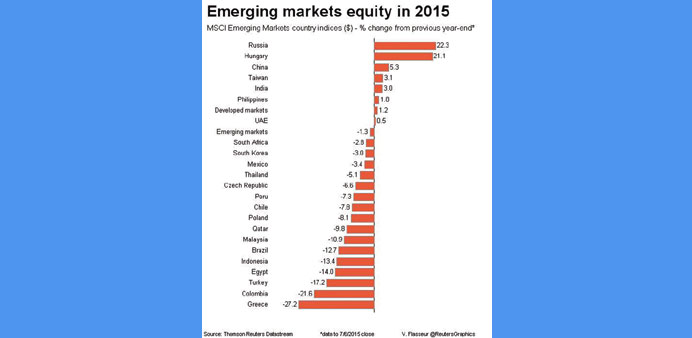

The latest drop for MSCI’s EM share index followed its biggest fall in two years on Monday. The slump has wiped more than 12% off its value since April. An expected rise in US interest rates and Europe’s worries about Greece helped cause the selloff. But a 30% plunge by Chinese stocks over the last month has been the main driver.

The CSI300 index of the largest listed companies in Shanghai and Shenzhen ended down 1.8% and the Shanghai Composite Index lost 1.3%. Both were unnerved by Chinese Premier Li Keqiang’s failure to mention the market chaos in a statement on the economy before markets opened.

“You just have to be active in these things,” said Jan Dehn at fund manager Ashmore in London. “We don’t have any exposure in the A-share market now because it’s down 30%. Maybe when it’s down 40%, we will buy some.”

The unease around China came despite support measures from Beijing in recent weeks. It continued to weigh on other Asian markets, including Hong Kong, Korea, Malaysia and Indonesia.

In the currency markets, the jitters saw South Korea’s won near a four-month low. The Malaysian ringgit hovered at 16-year low amid a corruption scandal now linked to the country’s prime minister.

Greece’s troubles also weighed on global risk markets. Before a eurozone summit later in the day, France and Germany told Athens to come up with serious proposals to restart aid talks. And on Monday the European Central Bank increased the amount of collateral they must provide to get emergency funding . Central and eastern European stocks fell 0.8% in morning trading as the potential fallout of a Greek exit from the eurozone on their largest export market – the eurozone – took their losses since mid-May to over 16%.