Reuters

Beijing/Shanghai

China froze share offers and set up a market-stabilisation fund yesterday, the Wall Street Journal said, as Beijing intensified efforts to pull stock markets out of a nose-dive that is threatening the world’s second-largest economy.

Beijing’s reported suspension of initial public offerings (IPOs) came a few hours after extraordinary announcements by major brokers and fund managers, which collectively pledged to invest at least $19bn of their own money into stocks.

China’s government, regulators and financial institutions are now waging a concerted campaign to prop up the nation’s two main share markets, amid fears that a meltdown would rock the financial system and inflict heavy losses across an economy where annual growth is already running at a 24-year low.

Almost $3tn in market value – more than the entire economic output of Brazil – has been wiped out since markets went into reverse last month, posing a bigger headache for many global investors than even the Greek debt crisis.

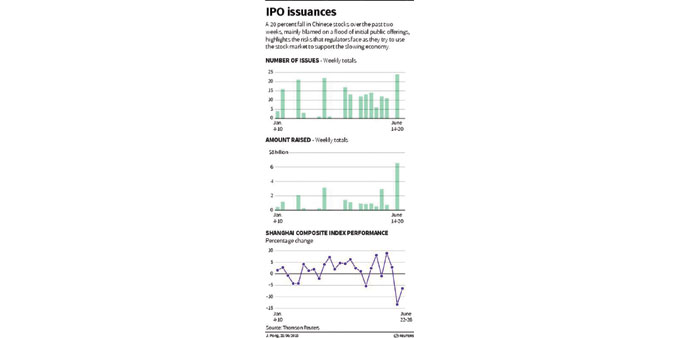

The main Shanghai Composite Index has lost around 30% of its value in three weeks, a dramatic end to an equally breathtaking rally that saw it more than double in just seven months, fuelled by official interest-rate cuts.

The sell-off is especially worrying because the bull market had been built on a mountain of speculative loans. Some analysts suggest total margin lending, both formal and informal, could add up to around 4tn won ($3.6bn).

The stock markets are dominated by retail investors.

Later, 28 Chinese firms announced in individual statements they would suspend their own IPO plans due to market volatility. They did not mention any central decision to halt IPOs.

The securities regulator had already said on Friday it would reduce the number of IPOs and other capital-raisings. The freezing of IPOs can lend support to a falling market because large amounts of money are frozen when subscriptions are taken, drying up liquidity in the market. Large IPOs have been cited as a reason for triggering the recent plunge.

Beijing has unleashed a barrage of official policy moves over the past week, including an interest rate cut, a relaxation of margin-lending rules and additional bank liquidity.

But these efforts have so far failed to convince investors.

Hong Hao, strategist at BOCOM International, doubted the move by brokers alone would be enough to stabilise share prices, unless even more leverage was added to the market.

“Around 120bn yuan is not enough, but if leverage (more borrowing) is used, it could expand to over 500bn yuan and that may have some effect,” he said.

In a statement, the Securities Association of China expressed “full confidence” in the development of China’s capital markets and said the brokerages would jointly invest 15% of net assets as of end-June, “or no less than 120bn yuan”, in blue-chip exchange traded funds.

The brokerages would not sell as long as the Shanghai composite remained below 4,500 points. The index fell 5.8% on Friday to end at 3,684 points.

Listed securities companies among the 21 brokerages also pledged to buy back shares, along with their major shareholders.