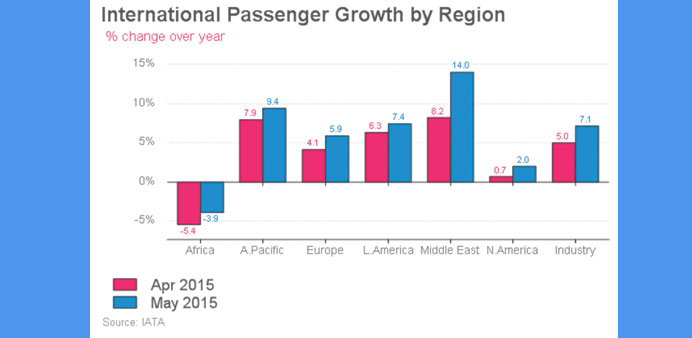

Driven by increasing market activities in the non-oil sector and a surge in pre-Ramadan travel, Middle East carriers’ passenger demand soared 14% in May over the same month in 2014, IATA has said in a report.

While the carriers’ capacity rose 19.7%, load factor fell 3.7 percentage points to 74.6%, it said.

Globally, the demand increased in both domestic and international passenger segments in May, particularly in Asia Pacific, IATA said.

Total revenue passenger kilometres (RPKs) rose 6.9%, which was an improvement on the April year-on-year increase of 5.7%. May capacity (available seat kilometres or ASKs) increased by 6.5%, and load factor rose 0.3 percentage points to 79.3%.

May international passenger demand rose 7.1% compared to May 2014, with airlines in all regions except Africa recording growth. Total capacity climbed 6.7%, pushing load factor up 0.3 percentage points to 78.4%.

Domestic travel demand rose 6.6% in May compared to May 2014, with the strongest growth occurring in India and China. Domestic capacity was up 6.2%, and load factor improved 0.3 percentage points to 81%.

“May results confirm that demand for connectivity remains robust, but there are possible storm clouds forming on the horizon. The financial crisis in Greece and recent weakness in regional trade activity in Asia-Pacific have the potential to dampen performance in these markets in the coming months” said Tony Tyler, IATA’s Director General and CEO.

“As we enter the busy summer travel season in the northern hemisphere, many millions of people will rely on aviation to explore the world or re-connect with friends and family. The mobility that is taken for granted by these travellers is the result of the efforts of 2.5mn air transport professionals working in careful cooperation to ensure safe journeys. It will also be clear that in many cases the infrastructure is insufficient to meet demand.

“Delays and crowded airports should send strong signals to government leaders to address critical choke points, implement risk-based security and advance much needed air traffic management modernisation in many parts of the world. NextGen in the US and the Single European Sky are the best known programmes which need political will to move forward. And in China, despite best efforts to minimise delays there is still much more work to be done,” Tyler added.

According to IATA, the economic outlook remained “broadly positive” with the fall in oil prices compared to mid-2014 expected to sustain growth and demand for passenger travel in 2015.

“Although weakness in emerging markets has caused improvements in business confidence to stagnate recently, some advanced economies are showing improvement, which should help support growth in air travel,” it said.