Reuters/Tokyo

Japan’s largest oil refiner, JX Holdings, said it would be open to talks on a possible merger, with the government pushing for consolidation in an industry struggling as people switch to more efficient cars and as the country’s population dwindles.

The company’s new president also told Reuters that JX, scrambling to recover from a record annual loss, could scrap at least one of its seven refineries to curb costs and as it looks to comply with a national drive to cut old and ageing capacity.

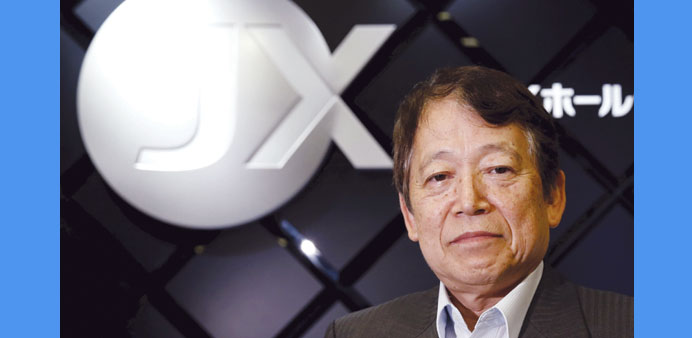

“We are ready to talk with anyone,” Yukio Uchida said, when asked whether he would consider a merger in his first interview with foreign media since taking over last week.

“We want to become one of the two or three (big) firms in the future. I don’t know whether we will remain intact as we are now.”

The government wants to slim Japan’s refining industry to two or three large firms, from a current ‘big five’ that also includes Idemitsu Kosan Co, TonenGeneral Sekiyu, Cosmo Oil Co and Showa Shell Sekiyu. Though any merger would need approval from the nation’s antitrust watchdog.

An average of nearly 20 gas stations has been closing each week in Japan, with demand for oil falling by about 22% over the last decade.

Use of oil for electricity generation is also gradually being phased out even as the Fukushima nuclear disaster led to the shutdown of all the country’s reactors. A slump in oil prices since last summer has piled more pressure on Japan’s refiners, with Uchida taking the helm at JX just after it reported an annual loss of $2.2bn, the largest since it was created from a merger in 2010.

The firm must also decide how it will comply with a government directive for the industry to reduce capacity by as much as about 10%, or a total of nearly 400,000 barrels per day (bpd), by March 2017. JX currently has 1.43mn bpd of crude refining capacity, 36% of Japan’s total.

Uchida said that one option would be to axe a whole refinery, bringing greater cost savings than other options such as reducing crude distillation unit capacity. He added that the firm’s next three-year business plan, to start in April, would include less total investment than the ¥1.3tn ($10.5bn) in its current plan.

Uchida: Planning to scrap at least one of its seven refineries to cut costs.