By Arno Maierbrugger/Gulf Times Correspondent /Bangkok

The market for Islamic insurance, or takaful, is seen to have high potential in Muslim countries of Southeast Asia, but more awareness needs to be created in a market where insurance penetration is generally low compared to Western standards.

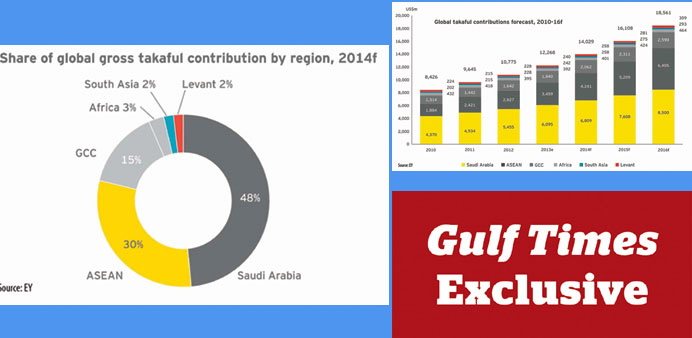

According to a recent report by consultancy EY (formerly Ernst & Young) entitled “Global Takaful Insights,” worldwide takaful assets should climb to $20bn by 2017 from an estimated $14bn last year, with Saudi Arabia, the UAE and Malaysia occupying the highest market share in the business. Southeast Asian countries, namely Malaysia and increasingly Indonesia, account for 30% of the global takaful market, compared to 48% share of Saudi Arabia.

The report points out that the two Southeast Asian nations have the potential to catch up with Saudi Arabia due to their young populations underserved by insurances and strong economic growth.

“Asean’s dynamos, Malaysia and Indonesia, will be key markets [for takaful] to watch as they enhance their market practices, widen their delivery channels and strengthen their regulatory infrastructures,” the report says.

In Malaysia, Islamic insurers are now attempting to double the number of policy holders in five years, according to Ahmad Rizlan Azman, chairman of the Malaysian Takaful Association, who said that the industry seeks a 25% market share, up from 14% at the end of 2014, and aims to boost customer numbers to 8.4mn by 2020 from about 4mn at present. To reach this goal, the sector will step up its educational strategies, marketing tools and digital technologies to reach out to a younger, tech-savvy audience.

Another report by business advisory firm Deloitte entitled “The Way Forward for Takaful” indicates that improved marketing techniques for insurance in general and Islamic insurance in the core market of Indonesia and Malaysia are certainly a necessity.

“Generally speaking, entire insurance penetration rates [in East Asia] are invariably less than 5%, with the exception of Malaysia, Singapore, Japan and Hong Kong, where penetration rates amounted to 5.1%, 6.2%, 10.1% and 11.5% respectively,” says Hatim El Tahir, head of the Deloitte Middle East Islamic Finance Knowledge Center in Bahrain, adding that “takaful players need to design crystal-clear products and market strategies to reach the mass market.”

Malaysia is seen to be best equipped to tap the future market. In 2012 and 2013, respectively, the country came up with the Takaful Operator Framework and the Islamic Financial Services Act, making the entire Shariah-compliant financial industry more transparent and efficient. This was followed by “Life Insurance and Family Takaful for Everyone,“ an initiative by Malaysia’s central bank to boost Islamic life insurance and related products.

In Indonesia, the world’s largest Muslim-majority country where 43% of the 240mn-population is younger than 24 years, the takaful industry’s written premium value has almost tripled between 2009 and 2013 with annual growth rates of more than 40%, research by UK-based business intelligence firm Timetric shows, with growth rates expected to remain on that high level at least until 2018.

The Indonesian Islamic life insurance segment, which has been dominated by “Islamic windows” of conventional insurers, emerged as one of the fastest growing in the Southeast Asia region, according to Timetric, with annual growth rates of around 53%. However, the research firm also expects a rising number of mergers and acquisitions in the industry, after a law came into effect in 2014 that requires conventional insurers to spin off their “Islamic windows” and established fully-fledged takaful operations with a minimum capital requirement of 50bn rupiah ($3.75mn), which some smaller firms are struggling to meet.

In contrast to conventional insurance, where an insurer takes over a client’s risk for a premium and the business model is to collect more in premium and investment income than is paid out in losses, takaful is an Islamic insurance concept where shared responsibility is taken over by a group of clients. They agree to donate regular contributions to a fund managed by a takaful operator, from which people and companies are being compensated when an insurance case occurs.