Samba Financial Group has cut its projections for 2016 and 2017 to $67 and $78/barrel respectively due to many “downside risks” and said the number of “hard to predict” factors seem likely to drive the market over the coming months. The impact of US shale output on the crude price is among these.

Doha

With market outlook remaining uncertain, Samba Financial Group has reduced its oil price projections for 2016 and 2017 even as it maintained its $60/b average this year.

Samba has cut its projections for 2016 and 2017 to $67 and $78/barrel respectively due to many “downside risks” and said the number of “hard to predict” factors seem likely to drive the market over the coming months.

The impact of US shale output on the crude price is among these, Samba said.

In its latest economic monitor, Samba said many questions remained “hard to answer” including whether the current Brent price between $60 and $65 were sufficiently high to prompt a resumption of shale oil drilling and a resultant pick-up in supply.

According to Samba, there was a “significant risk” of resumption in US shale growth that would put downward pressure on prices.

Such pressure would be accentuated by any deal with Iran, possible further strengthening of the US dollar, and of course any softening in global demand growth.

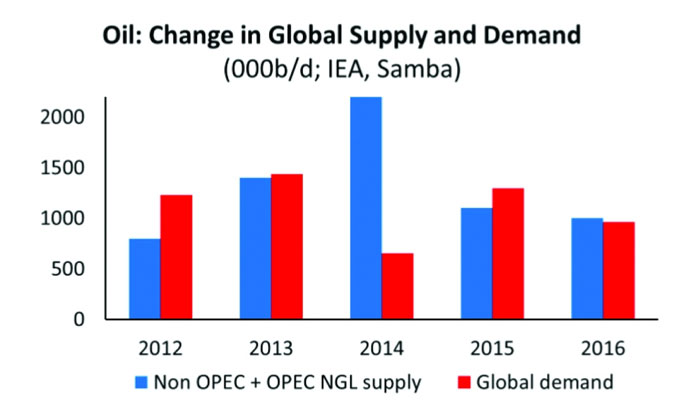

The latter, in any case is not expected to grow by more than 1mn barrels per day a year from 2016 onwards.

Given that negotiations are due to end this month on a potential agreement on Iran’s nuclear programme, which could lead to a relaxation of oil sanctions, there seems to be a surprising lack of concern in the market. Although an agreement is not certain, it is looking more likely than before. Admittedly, even if there is a deal, there is unlikely to be an immediate easing of sanctions, which will no doubt be contingent on meeting conditions.

But it seems prudent to start pricing in some significant return of Iranian supply during the next 6-12 months, possibly in the region of 600,000bpd.

With Opec not expected to curb output to make room for Iranian supply, this will have a significant bearing on market fundamental balances.

While higher cost supplies from other non-Opec producers are expected to be curtailed in the new lower price environment, this will not happen overnight and some increases (e.g. from Canada) are already baked in.

“Combined with unconstrained supply from Opec, it is hard to see where support for much higher prices will come from. This is certainly the view of futures markets, which are not expecting prices to hit $75/b until 2020.

“We are not so downbeat, and see considerable scope for supply disruptions and a less robust production path for non-Opec producers, including US shale,” Samba said.