By Pratap John/Chief Business Reporter

Major infrastructure investment in Qatar will go ahead on the back of planned and ongoing capital expenditure (capex) worth around $200bn, a new report has shown.

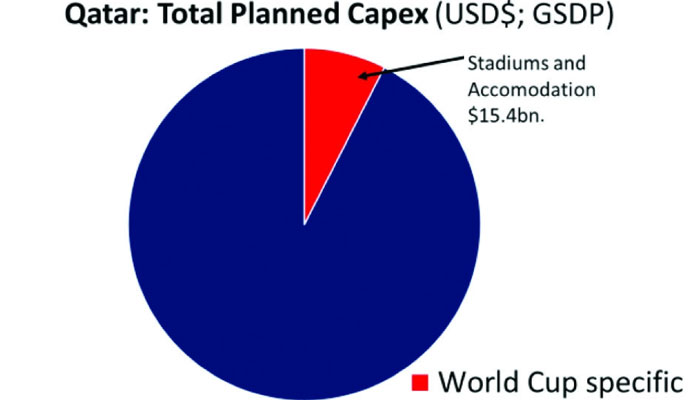

The spending explicitly linked to the world cup is about $15.4bn, which represents only 7.5% of the capex, Samba Financial Group said in a report.

Aided by large reserves (the Qatar Investment Authority's (QIA) holdings are estimated at $256bn) built up from years of accumulated oil and gas revenues, Samba expects that authorities concerned will continue to implement the spending set out in the National Development Strategy (NDS) when oil prices were more than $100 a barrel.

“Having said that, the prospect of declining fiscal and external balances will prompt the government to take a more considered approach resulting in slower project approval and execution,” Samba said in its latest country report.

Samba maintains the view that the tournament will go ahead in Qatar in 2022, even as it touched upon the issue of a possible re-vote on the issue.

“It is therefore important to reiterate that the vast majority of the planned capex is ancillary and planned independently of the World Cup.”

The “importance” of the World Cup, Samba said is that it “provides an impetus” to project activity and a definitive timeline. The spending explicitly linked to the World Cup is small (stadiums: $3bn; accommodation $12.4bn), this represents around 7.5% of the total planned capex.

“In a hypothetical scenario, if the World Cup capex is cancelled then the metro and Lusail City projects may well be scaled back – as well as the pace of project execution. All this would mean a scenario where GDP growth is clipped by perhaps one percentage point annually, but still registering above 5% year on year.

“There would also be positive spill-overs: a less congested project timeline will facilitate more efficient management and a greater return on capital. It would also allay fears of overcapacity and localised inflation.”

Qatar’s economy expanded by 6.2% in 2014, maintaining the pace set in 2012, it said. The non-hydrocarbon sector continued its double-digit expansion, which was driven by construction, with finance and trade, restaurants and hotels also making notable contributions.

Over the next few years, Samba expects other services to catch up with the construction sector as some projects enter the completion stages and the booming population acts as a catalyst for domestic demand.

Despite being the drag on growth in 2014, the hydrocarbon sector should provide a fillip to GDP in 2015 as additional upstream hydrocarbon production comes online from the Barzan Gas Project.

However, the self-imposed moratorium on fresh development the north field and a lower oil price means that the primary driver of growth over the medium term will continue to be the non-hydrocarbon sector, Samba said.