Local banks saw their loans and deposits drop in April after a growth in March, mostly due to the public sector activities, QNB Financial Services said in its monthly banking sector update.

The loan book decreased by 0.5% month-on-month (MoM) and (+2.9 year to date - YTD) after growing by 3.2% MoM in March (gaining by 1.7% MoM in February).

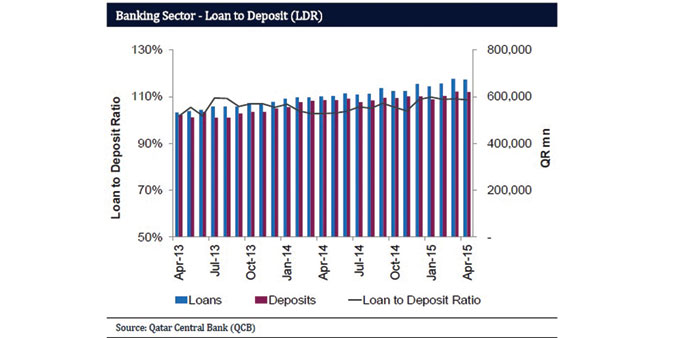

Deposits followed suit and dipped by 0.2% MoM (+3.1 YTD) in April. Public sector pulled down total credit growth with a decline of 4.7% MoM (down 5.9% YTD). Moreover, public sector deposits receded by 4.8% MoM (down 4.5% YTD). Thus, the loans-to-deposits ratio (LDR) remained at 109% in April.

The public sector deposits dropped by 4.8% MoM in April compared with a decent growth of 1.3% MoM in March.

Delving into segment details, the government institutions’ segment, which represents 57% of public sector deposits, declined by 8.3% MoM (down 4.4% YTD).

Moreover, the government segment receded by 6.9% MoM (down 4.5% YTD) after surging by 50.1% MoM in March (dropping by 11.4% and 22.9% in February and January respectively).

On the other hand, the semi-government institutions’ segment posted a strong performance, expanding by 13.6% MoM (down 4.9% YTD).

On the private sector front, the companies and institutions’ segment climbed up 1.1% MoM (down 1.3% YTD). The consumer segment followed suit and ticked up by 0.8% MoM (+5.7% YTD). Non-resident deposits grew by 10.7% MoM (+45.5% YTD).

The overall loan book reversed its growth trajectory and declined MoM, QNBFS said.

Total domestic public sector loans decreased by 4.7% MoM (down 5.9% YTD) compared with a robust growth of 4.7% MoM in March. The government segment’s loan book contracted by 23.5% MoM (+5.7% YTD) compared with a robust growth of 23.7% in March.

On the other hand, the government institutions’ segment (representing 64% of public sector loans) exhibited a healthy performance (+2.8% MoM) after putting up a flat show in March (+0.4% YTD).

Furthermore, semi-government institutions’ segment expanded by 6.1% MoM (down 7% YTD). Hence, the government sub-segment pulled the overall loan book down for the month of April 2015. Private sector loans grew by 1.9% MoM (+6.7% YTD) compared with a 3.1% rise MoM in March. The consumption and others segment followed by general trade positively contributed toward the loan growth.

Loans to the consumption and others segment (that contributes 31% to private sector loans) expanded by 4% MoM (+11.8% YTD) while general trade increased by 5% MoM (+8.8% YTD).

Moreover, the real estate, which contributes 25% to private sector loans and contractors segments increased by 1.1% MoM (+0.2% YTD) and 1% MoM (+7.3% YTD), respectively.

On the other hand, services segment, which contributes 18% to private sector loans, dipped by 2.2% MoM (+5.4% YTD).