The UK electorate appears to agree with the conclusions that “fiscal austerity and leaving the EU could be too damaging”, QNB has said in a report.

The UK’s parliamentary elections are taking place on May 7. Based on recent polls, the two main parties are neck and neck (Labour and the Conservatives both have around 33% of the popular vote) while smaller parties are expected to increase their representation in parliament.

Consensus expectations now favour a hung parliament—political odds put the combined likelihood of a Conservative or Labour majority at only around 9%—making protracted post-election negotiations likely, QNB said.

The political odds marginally favour a Labour-led minority government or coalition as the most likely outcome of negotiations (55% probability). The main differences between the economic policies of the two main parties are their plans for fiscal austerity. Labour would implement austerity at a slower pace than the Conservative party. Based on stated policies, this should lead to a slower pace of fiscal consolidation, which could be a good result for the economy and financial markets, although there is considerable uncertainty around this outcome.

In the run-up to the last election in 2010, the UK was running a fiscal deficit of 10.8% of GDP and public debt was 66% of GDP. The Conservative and Liberal Democrat coalition faced a tough choice such as implementing austerity to lower the risk of a fiscal crisis but pay for it with lower growth or no austerity, which would sustain growth at the risk of a fiscal crisis, similar to that which hit Greece, Italy and Spain. The coalition felt that the benefits of avoiding a fiscal crisis outweigh the costs of lower growth in the short term. They decided to implement an austerity programme to come close to eliminating the deficit by 2015. Austerity implies lower spending and higher taxes, which reduces aggregate demand, creating a fiscal drag on growth.

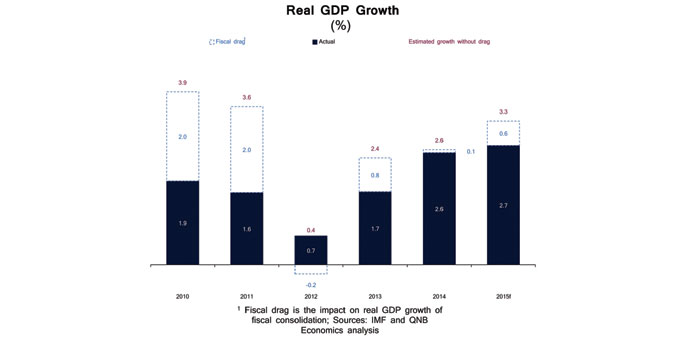

The austerity programme had a significant impact on the British economy, shaving an estimated 2% off GDP growth in each of 2010 and 2011, the report said.

However, the blow was softened by easy monetary policy through near-zero interest rates and multiple rounds of quantitative easing by the Bank of England (BoE). The austerity programme was relaxed in 2012 as the economy stagnated, substantially reducing the fiscal drag on the economy. This has played a significant role in the recovery of the UK economy towards the end of the current parliament. Real GDP growth was 2.6% in 2014 and data released last week indicated that it was 2.4% in the year to Q1, 2015. UK asset prices have also received a boost—the stock market is near all-time highs and London house prices are now the second highest in the world after Monaco.

Like 2010, divergent views on fiscal policy are still taking centre stage in this year’s elections. All the main parties agree that further fiscal consolidation is needed but there are important differences on the pace of consolidation. The Conservative party plans to target a 1% overall budget surplus by 2019/20 from a 4.1% deficit in 2014/15. Meanwhile, the Labour party plans an easier fiscal trajectory and intends to balance the current budget deficit (excluding investment spending) by 2017/18.

But there are two key differences to the last election in 2010. First, the risk of a fiscal crisis in the UK is much lower now than in 2010. The deficit has almost halved to 4.8% of GDP in 2014 and interest rates on UK sovereign debt are at record lows. The need for austerity, therefore, seems less pressing.

Second, monetary policy did most of the heavy lifting post-2010 elections. But this is different today, given that the BoE is expected to tighten monetary policy early next year. When austerity was implemented in 2010, monetary policy softened the blow, but this time tighter fiscal policy could be combined with tighter monetary policy, which could prove too damaging for growth. A more gradual pace of fiscal consolidation might therefore be more growth-friendly.

Outside the fiscal debate, the Conservatives (if they win the election) have pledged to hold a referendum in 2017 on whether the UK should remain a member of the European Union. Although this could be highly destabilising, it is now unlikely to go ahead. It would need either a Conservative majority (8% probability) or a Conservative coalition (21% probability) solely with the anti-EU UK Independence Party, which would only garner 43% of seats in parliament based on current polls.

“Nonetheless, the uncertainty created by the referendum around the UK’s position in the EU (by far the UK’s largest trade partner) could be damaging for the economy and businesses,” QNB said.

The UK electorate appears to agree with the conclusions that fiscal austerity and leaving the EU could be too damaging. Based on the latest political odds, Labour is the party that is most likely to lead the next UK government, either a minority government (36% probability) or a coalition (19%).

Therefore, the outcome of the elections should bear the closest resemblance to Labour party policies.

“This may mean less austerity, which should be good for the economy, financial markets and asset prices in the medium term,” QNB added.