Reuters

Vancouver

Pure-play silver miners, a niche investment market popular with retail investors, are moving up the endangered list.

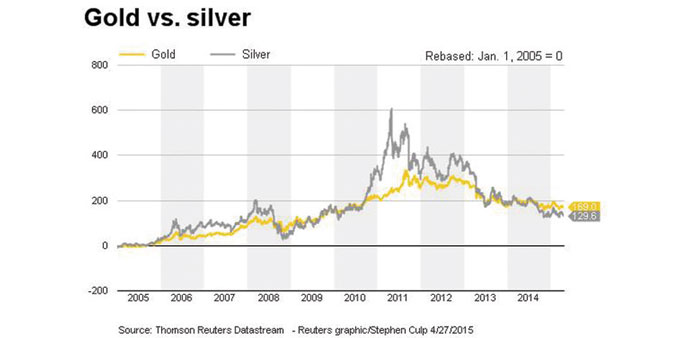

Buffeted by a 68% plunge in the price of silver since 2011, miners who traditionally made most of their money from silver are increasingly diversifying into gold, buying mines that have been put up for sale and looking to acquire more. In addition to spurring deals in the precious metals space, the trend is reducing investment avenues for those wanting to take a bet on a commodity that often outperforms gold when bullion is rising.

“The real silver nuts such as myself like pure silver companies. The more leveraged to silver the better... but you have to be able to tolerate the risk,” said David Morgan, founder of the Silver-Investor.com website.

According to BMO Capital Markets, large primary silver miners have increased their gold output on average by 19.4% a year since 2009 to 2mn ounces.

That makes them faster-growing gold producers than gold miners themselves. In that same period, large gold producers increased their gold output by 2.8% on average annually.

Helping drive this trend is big gold miners’ sales of smaller, non-core operations as they try to cut costs and debt. Although gold has outperformed silver, it is still down nearly 40% since 2011.

Mother nature is also a factor in the silver-to-gold shift. Large, high-grade silver deposits have always been scarce and are becoming more so. Already some 70% of silver is mined as a by-product from copper, gold, lead and zinc mines.

“I don’t see enough discoveries for all the silver companies that exist right now to be able to maintain silver production and replace it. They are becoming precious metal producers because they kind of have to,” said BMO analyst Andrew Kaip. “The days of the pure silver producers are behind us.”

Recent gold mine acquisitions by silver producers include US-based Coeur Mining Inc’s purchase of South Dakota’s Wharf mine from Goldcorp Inc and Silver Standard Resources Inc’s purchase of Nevada’s Marigold mine from Goldcorp and Barrick Gold Corp. Mexico-headquartered Fresnillo Plc, the world’s biggest primary silver producer, last year increased its gold exposure when it bought out Newmont Mining Corp’s stake in their gold joint venture in MexiCo.

“If we look for M&A in the future, we will consider both (silver and gold),” said John DeCooman, Silver Standard’s vice-president of business development and strategy. Largely due to the Marigold purchase, Silver Standard’s proportion of revenue from silver dropped to 39% in 2014 from 91% in 2013, company data shows. Revenue from gold rose to 53% from zero. BMO estimates that silver sales will make up only 51% of silver miners’ revenue this year, down from 67% in 2011.

Silver demand has been steady in recent years as coin and bar buying by collectors and demand for electrical equipment waned while that for jewellery grew. Over the past ten years, the emergence of digital photography has eroded long-term demand in that area. Thomson Reuters GFMS expects physical consumption to reach 1.02bn ounces this year, up from 1bn last year. Large fund managers have generally been sympathetic toward silver miners’ move to spread their bets.

“It doesn’t really matter to me whether they are mining silver, gold or both. It comes down to the quality of the mines and the quality of the company, not the commodity,” said Joseph Foster, portfolio manager at Van Eck Global, one of the precious metals sector’s biggest institutional investors.