By Pratap John

Chief Business Reporter

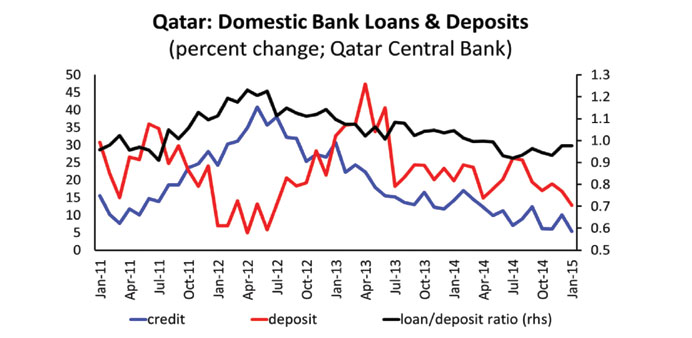

Qatar banks’ lending to the private sector remains buoyant and is expected to support double digit credit growth over the next couple of years as activity accelerates in the run-up to FIFA 2022, a new report has shown.

But, according to Samba Financial Group, overall lending in Qatar has been soft of late, running at around 6% mainly due to a pull-back in credit to the public sector.

“The composition of credit growth shows loans to contractors and for consumption expanding at a healthy rate in Qatar,” Samba said in its latest report.

According to Samba, Qatar is in a “relatively strong position to weather the recent collapse” in oil prices.

Qatar has been sheltered to some degree from the fall in the oil price due to its large LNG revenues. However, LNG prices have also come under pressure recently, having previously shown some significant resilience.

At present, around 70% of global LNG trade is tied into long-term contracts, the majority of which are in some way indexed to the oil price. Many of these contracts are devised to shelter LNG revenues from sharp swings in oil prices as illustrated in this notional ‘S’ curve contract, the report said.

Qatar has enjoyed “large Asian price premium” in recent years, as over 60% of its LNG sales are in the region.

“However, the market is changing”, Samba said.

Of late, the premium between Asian and European gas prices has diminished. Although the factors behind this may be short term (large reserves in Japan and Korea), the long-run dynamics of the market suggest this trend may endure.

There are “substantial plans underway” in both Australia and the US to begin large exports of LNG over the next five to 10 years, Samba noted.

In fact, some analysts predict Australia will surpass Qatar as the world’s largest exporter of LNG by 2019. China also harbours ambitions of increased gas production for domestic use.

These plans were initiated when oil prices were much higher, and are thus subject to some uncertainty. Nonetheless, though Samba expects demand for gas to remain resilient, increasing supply over the next decade and beyond will likely put pressure on prices and the Asian premium in particular.

“The short-term implications for Qatar include a substantial fall in hydrocarbon revenue and pressure on the fiscal balance as spending remains elevated in the run up to the World Cup.

“Though it is likely that Qatar may record a small fiscal deficit this year, it seems the authorities could avoid this by adjusting the flow of funds from the large hydrocarbon export earnings.

“Though we think it likely the fiscal accounts will record a marginal deficit this year, this could be avoided through a reduction in the allocation of hydrocarbon revenues to various accounts including the Qatar Investment Authority (QIA). That said, there are ample international reserves (around $41bn) and more importantly QIA assets of around $256bn, to cover a deficit if needed,” Samba said.

These large external assets will, in Samba’s view, allow the ambitious investment spending programme to continue, albeit with increased focus on prudence and prioritisation. Evidence of such activity is apparent in the latest national accounts; the non-hydrocarbon sector was the sole driver of growth in the third quarter 2014, which accelerated to 6%.

Samba has noted that inflation is still a concern in Qatar given the congested project timeline and increasing capacity constraints (rental inflation averaged 7% over 2014).

However, weak commodity prices and a strengthening dollar should keep a lid on inflation, which is projected to average 3.3% in 2015, it said.