Reuters

Manila

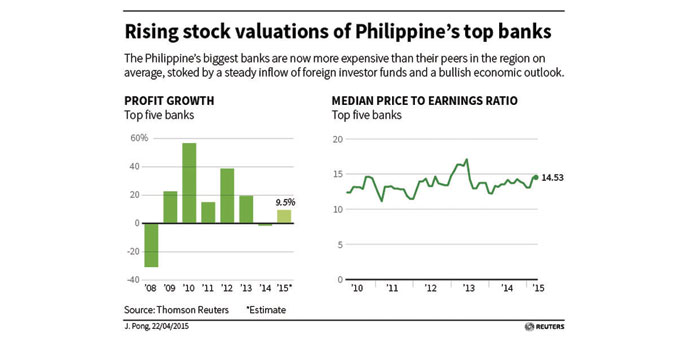

The Philippines’ biggest banks may be the smallest lenders in Southeast Asia by market cap, but they are now more expensive than their peers in the region, stoked by a steady inflow of foreign investor funds and a bullish economic outlook.

The median price-to-earnings (PE) ratio of Bank of the Philippine Islands (BPI), BDO Unibank Inc, Metropolitan Bank & Trust, Philippine National Bank and Security Bank rose to 14.53 this month, the highest since June 2013, Reuters StarMine data shows. In contrast, the median PE ratio of their regional peers was at11.17.

Investors are expecting Philippine banks to turn the corner this year as they focus on consumer loans, mortgages and corporate lending in an economy supported by strong domestic demand and public infrastructure projects. The five banks are forecast to swing to a combined profit increase of 9.5% this year from a 1.5% contraction in 2014.

The banks posted their first annual profit decline in six years in 2014 as the hefty gains from selling government bonds to institutional investors decreased substantially. Government bond prices slumped and market liquidity shrank as the outlook for US interest rates turned hawkish. “Banks now lack huge trading gains,” Roberto Juanchito Dispo, president of First Metro Investment Corp, told Reuters. “The strategy of the banks is to grow their loan portfolio, increase their exposure on consumer loans and support infrastructure projects by big conglomerates.”

BDO and BPI said they expect their loan books to grow at least in the high-teens this year, almost the same as last year, on the back of loans for housing and cars. But it is not all clear skies. A number of Asian banks are looking to start lending or open offices in the Philippines as their domestic markets languish, promising to ramp up competition in the sector in the months ahead.