Bloomberg

London

Dubai-based online retailer Souq.com, backed by investors including Tiger Global Management, is seeking $300mn for expansion, according to three people with knowledge of the matter.

The fundraising would value the business at about $1bn, the people said, asking not to be identified as the information is private. New York-based Tiger Global and South Africa’s Naspers Ltd, another existing investor in the company, are leading the fundraising, two of the people said.

Private market valuations of Internet companies including Spotify Ltd, Snapchat, and Uber Technologies have been rapidly growing, following the rise of publicly traded social media companies such as Facebook. Uber’s valuation has more than doubled in six months to $40bn. Souq.com raised $75mn from Cape Town-based Naspers in March last year, in a deal it said at the time was the largest for an Internet-based business in the region. That deal brought the total raised by Souq.com since its inception to $150mn. Tiger Global said in January that it has invested in more than 100 e-commerce and online classifieds businesses over the past 13 years. Many current holdings in consumer Internet companies are in China, it said. Tiger has stakes in Internet companies including Autohome Inc, an online auto portal, and Alibaba Group Holding Ltd, China’s biggest Internet company.

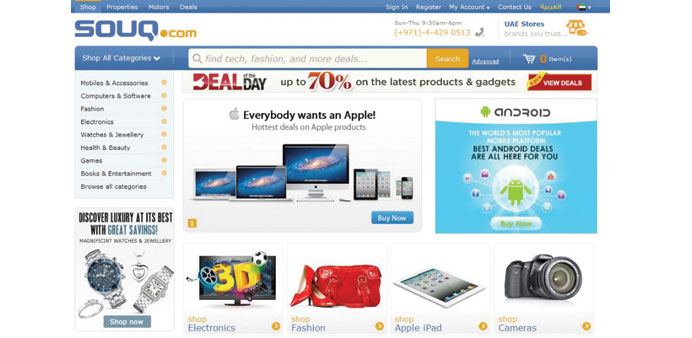

Dubai-based Souq.com, which operates a similar business model to Amazon, was established in 2005. More than 10mn visitors view its catalogue of products including electronics, watches, household goods and toys each month, according to its website.

The online commerce market in the Middle East will be worth $15bn this year, with about 10% of transactions on mobile devices, according to a PayPal Inc report.

More than 10mn visitors view Souq.com’s catalog of products including electronics, watches, household goods and toys each month, according to its webs