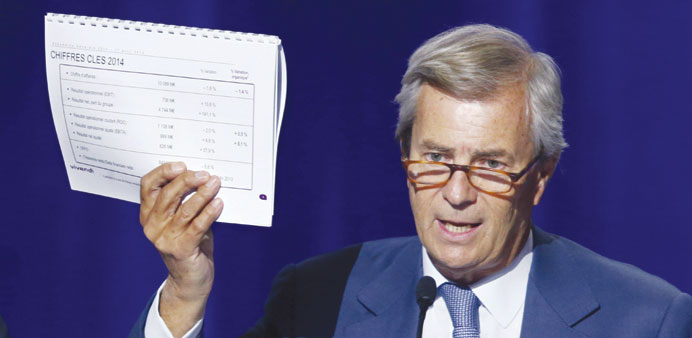

Vincent Bollore, chairman of Vivendi and largest shareholder, shows off documents as he speaks during the company’s shareholders meeting in Paris yesterday. Bollore won the right to exercise double voting rights as rebel shareholders failed to win enough votes for their resolution to maintain a one-share-one-vote structure.

Reuters/Paris

Vivendi’s chairman and main shareholder Vincent Bollore won double voting rights at the company’s annual shareholders’ meeting yesterday after opponents failed to get support for their motion to keep a one-share-one-vote structure.

Bollore, a billionaire who made his name as a corporate raider, says giving him tighter control of Vivendi will enable him better to create a competitor to powerful, rich rivals like Google and Facebook.

But the man who built transport and logistics company Bollore Groupe told shareholders at the meeting that it would take time to build Vivendi into a media powerhouse, warning that attractive deals in the industry were thin on the ground and the risk of overpaying considerable.

Vivendi is in transition phase after selling off four of its six businesses and exiting telecoms completely. It has a €15bn ($16.18bn) war chest that it wants to deploy to become a European champion in media, building on its Universal Music Group and pay-TV business Canal Plus.

Only 50.05% of shareholders voted in favour of the rebel resolution that would have kept the principle of one vote, one share. Under a law taking effect next year, a two-thirds majority is needed to stop the double voting rights switch.

Bollore told the annual general meeting that double voting rights were “in the interest of all holders” not just himself, adding: “Just look at Google or Facebook, where founders have a strong hold on groups and therefore can move very quickly.”

Once he has double voting rights, the tycoon will be able to decide almost single-handedly what happens next to Vivendi. Double voting rights already exist at many French companies and are set to become more widespread after France’s Socialist government passed a law last year to grant them to shareholders registered for more than two years.

The move came about because the state wants to keep its influence at companies like Renault and Orange while it sells off part of its stake in them to fund a reduction in the national debt. Eleven blue chips are trying to override the double voting rights law, and Vivendi was the only non-state backed one where the management did not propose and support a resolution to override the law.

Bollore also told shareholders that Vivendi had to be realistic about its acquisition ambitions since sellers would not let go of media assets at cut-rate prices. “None of the owners of media assets are going to sell us great businesses for less than their market value. So it’s up to us to pay the right, fair price, then create value,” Bollore said.

Vivendi has been scouting for media targets in the past year and had pitches from bankers about various options including a mega deal to takeover European pay-TV leader Sky and smaller moves to expand in radio, magazines and publishing.

Earlier this month, Bollore made its first acquisition by buying video-sharing site Dailymotion for €217mn from French telecom group Orange, which had been looking for a buyer for years only to see the government scupper its sale to US and Chinese buyers.

Dailymotion has struggled to compete with much larger rival YouTube, which is owned by Google, attracting 128mn unique visitors per month versus 1bn for YouTube. It has less than 100mn euros in sales compared to nearly $4bn for YouTube.

“On acquisitions we will not be satisfied with only Dailymotion this year,” Bollore told the audience, adding that Vivendi’s strategy committee would meet on May 12 to discuss acquisition opportunities.

Exane BNP Paribas analysts said Bollore’s comments confirmed that “big deals are unlikely and that value creation will take time”. Bruno Hareng, analyst at Oddo Securities, said the lack of clarity over Vivendi’s acquisition plans could weigh on the shares in the coming months.

Nevertheless Bollore’s track record at creating value at companies from advertising agency Havas to industrial parts maker Vallourec should comfort investors

“We think the acquisitions will be modest in size (from €1bn to €4bn) and subject to strict financial criteria, just as Bollore has done at Havas,” Hareng said.

Vivendi shares were down 1.3% at 12:38 GMT, compared with a 1.5% drop for the French blue-chip index.