Reuters/London

With signs of a revival in eurozone growth failing to lift government bond yields off historic lows this week, investors have started to fear the ECB’s asset-purchase scheme may be inflating a dangerous bubble.

Since the European Central Bank launched its €1tn quantitative easing programme early this month, data has broadly beaten forecasts while long-term market inflation expectations have crept towards the ECB’s target of just below 2%.

While this should point to an eventual tightening of monetary policy, and a normalisation of interest rates, a third of the bloc’s government bond yields remain anchored below zero.

“I’ve long resisted likening the bond rally to a ‘bubble’ but we are certainly seeing some pretty extraordinary events that make us question what’s going on,” AXA WF Global Strategic Bonds manager Nick Hayes said. “For me, 2015 should be about ‘yield give up’ not ‘yield pick-up’.”

Strategists polled by Reuters this week were evenly split over whether the government bond market was exhibiting signs of an asset bubble.

Business activity as measured by Markit’s flash composite purchasing managers’ index for March was the highest recorded in any month since May 2011, and there are signs the recovery is also accelerating in the 19-nation bloc’s weaker economies.

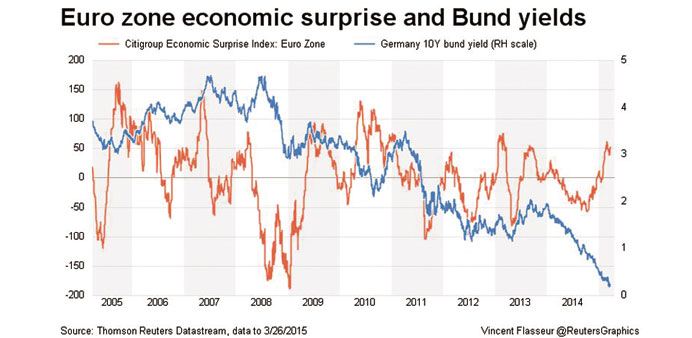

Historically, positive economic surprises have usually dragged yields higher, but this relationship has broken down since the middle of last year, when speculation the ECB would launch a quantitative easing programme began to intensify.

“European bonds are overvalued from a fundamental perspective, they look expensive relative to both other government bonds and other asset classes,” said UBS in a note, predicting the recent rally will soon reverse course. A survey released this week by the CFA Society of the UK showed more than 80% of 272 investors felt government bonds were overvalued, the most of any asset.

Three quarters of those investors also considered corporate bonds overvalued, the highest percentage since the survey began three years ago.

Rock-bottom consumer price growth - exacerbated by a slump in oil prices - offers some comfort to investors who argue that in ‘real’ terms these low yields are justifiable.

But there are signs crude may be on the rebound. Prices are set for their biggest weekly gain since the start of February.

The eurozone will report preliminary flash inflation data next week, which some analysts said should bolster expectations it is fending off a deflationary spiral. Some in the market are already cutting their bond exposure in anticipation of a reversal in the rally.

“We have entered a short position in Bund futures and we’ve also gone slightly short on peripheral government debt, mainly because we don’t see any more room for spread compression either in Bunds or peripheral govvies with valuations looking relatively stretched,” said Garrett Walsh, head of credit research, Europe, at Pioneer Investments, which manages assets worth about $238bn.

“In addition to that, we have gone long breakeven inflation through swaps and through bonds, mainly to position for the reflation trade that we start to see happening.”

With the ECB buying up bonds at a rate of €60bn a month, and investors looking to reinvest a raft of coupon repayments and bond redemptions that fall due next week, some analysts expect yields to fall even further.