Bloomberg/London

Emerging-market stocks and currencies advanced for the first time this week on speculation European Central Bank asset purchases will boost appetite for riskier assets. The rouble headed for a 2015 high.

Equity gauges in Russia, Indonesia and Nigeria climbed at least 1.1% as the ECB set Monday as the date it will start bond buying amounting to €60bn ($66bn) a month.

Russia’s currency led gains among developing nations, appreciating 2.1% to 59.585 per dollar. It’s poised to close below 60 for the first time since December 30 amid a rebound in oil and cease-fire in Ukraine. The hryvnia was set for its best week on record after an interest-rate increase.

Along with ECB stimulus, US payrolls data “should be supportive for global growth: US in the short term and eurozone in the longer term,” Simon Quijano-Evans, the head of emerging-market research at Commerzbank in London, said by e-mail.

These will “help make up for any shortfall in China’s growth story,” he said.

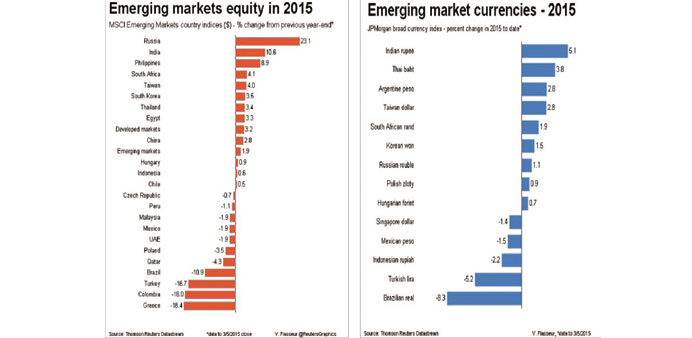

The MSCI Emerging Markets Index, which gained 0.3% to 977.62 yesterday, has fallen 1.3% this week after China set its lowest economic-growth target in more than 15 years. A US jobs report will show increases in nonfarm payrolls stayed above 200,000 for a 12th month, economists said in a Bloomberg News survey.

A gauge tracking 20 emerging-market currencies climbed 0.2% to 77.8308 by 11:35 a.m. in London, after closing at a record low in the previous four days.

The rouble strengthened 1.9% in 2015, the largest appreciation among 24 peers in developing countries and compared with drops of 11.5% and 10.5% for the Brazilian real and Turkish lira.

Russian assets recovered as Brent crude, the benchmark used to price the nation’s main export blend, bounced back from a six-year low of $45.19 on January 13 to $60.93 yesterday. Ukraine withdrew more weaponry from the frontline in its easternmost regions as the peace accord signed February 12 takes hold.

The hryvnia climbed 1.1% to 22.75 per dollar, trimming the slump in the past 12 months to 39%.

The dollar-denominated RTS Index rose 1.1% in its second day of advances as OAO Sberbank climbed 1.2% in Moscow trading. The benchmark stock index in Nigeria, Africa’s largest oil producer, added 2.4% to the highest level since January 8.

OTP Bank led a 1.8% increase in Hungarian stocks, while the Borsa Istanbul 100 Index climbed 0.7% from a 2-1/2-month low.

The gauge slid 3.3% this week as Citigroup’s decision to sell its remaining stake in Turkish lender Akbank TAS at a discount dented investor sentiment. The bank’s shares climbed 0.4%, trimming the weekly loss to 6.1%.

The lira, which was little changed yesterday, was poised for its worst weekly performance since January 2014. It slid to a record 2.6281 a day ago as the economy minister added to government pressure on the nation’s central bank to accelerate interest-rate cuts.

Concern that Turkey will encroach on the body’s autonomy has pushed the nation’s bonds lower in the past month, driving yields up the most in emerging markets.The premium investors demand to own developing-country debt over US Treasuries narrowed two basis points to 348, JPMorgan Chase & Co indexes yesterday showed.

Indonesia’s equity gauge closed at a record. Samsung Electronics gained 1.4% to a nine-month high in Seoul, while OCI Co and Hanwha Chemical Corp jumped more than 9% as concerns of a supply glut in polysilicon eased.

The Shanghai Composite Index capped its first weekly drop in a month on concern that new share offerings next week will divert funds from existing equities.

China on Thursday set its growth target for 2015 at about 7%, down from about 7.5% last year and the lowest in more than 15 years.

The MSCI Emerging Markets Index has gained 2.2% this year and trades at 11.8 times projected 12-month earnings, data compiled by Bloomberg show.

The MSCI World Index has risen 3.3% in 2015 and is valued at a multiple of 16.8.