Reuters/London

Earnings growth at European companies is expected to overtake that of US peers for the first time since 2010 thanks to cheaper oil, euro weakness that aids competitiveness and a generally brighter economic backdrop.

The resurgence of confidence in Europe is likely to prompt more switching out of US shares – which look less attractive as the stronger dollar hurts export-oriented firms – and boost European indexes that have already scaled multi-year highs.

The broader STOXX Europe 600 index and the eurozone’s blue-chip Euro STOXX 50 index have both climbed about 15% this year, compared with a rise of just 2% for New York’s Standard & Poor’s 500.

After suffering badly in 2008 and 2009 following the financial crisis, US earnings recovered and grew faster than those in Europe between 2010 and 2014. But that trend is set to change this year.

Consensus earnings per share (EPS) growth forecasts for Euro STOXX 50 and STOXX 600 firms now stand at 9.5% and 5% respectively for 2015, against 1.8% for S&P 500 companies, according to Thomson Reuters Datastream.

“Earnings momentum is building in Europe. The currency and an improving economy are the two main drivers of our positive forecast,” said Robert Parkes, director of equity Strategy at HSBC Bank, adding HSBC recently raised its 2015 growth forecast for Europe to 25% from 16% estimated earlier.

HSBC’s forecast excludes stocks listed in Britain, whose economy has outperformed big eurozone peers in recent years. “Whilst US earnings are at a record high, European earnings are depressed and at a cyclical low. It is normally at this point in the cycle that European earnings surprise on the upside,” Parkes said.

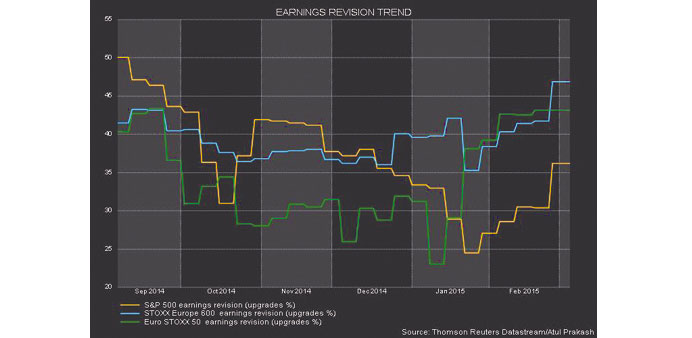

There are some other positive indications. Although analysts are still downgrading more EPS estimates than they upgrade, both in Europe and the US, the pace of downgrades in Europe is slowing.

Europe is now witnessing about 53% downgrades out of total forecast changes, down from 77% at the start of 2015. In contrast, 66% of US EPS estimates are being downgraded, versus 75% in January.